EASE 4.0 | 26 Aug 2021

Why in News

Recently, the Union Finance Minister undertook the annual performance review of the public sector banks (PSBs) and launched the EASE 4.0 or Enhanced Access and Service Excellence Reform Agenda.

- EASE 4.0 is a common reform agenda for PSBs aimed at institutionalising clean and smart banking.

Key Points

- About Ease 4.0:

- EASE 4.0 commits PSBs to tech-enabled, simplified and collaborative banking to further the agenda of customer-centric digital transformation.

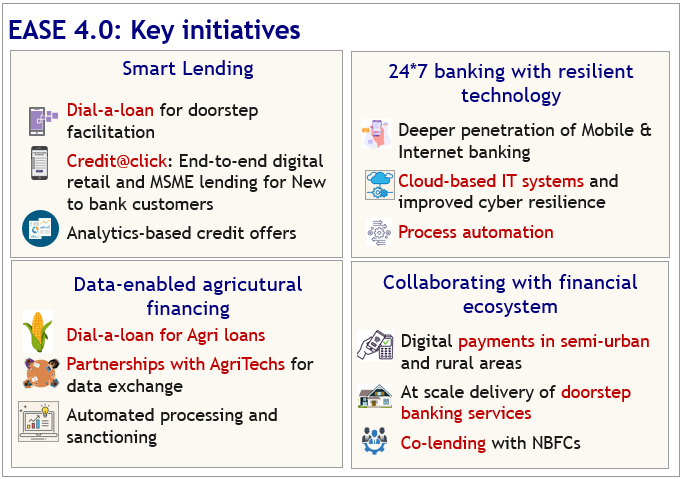

- Following major themes were proposed under this:

- 24x7 Banking: Under EASE 4.0, the theme of new-age 24x7 banking with resilient technology has been introduced to ensure uninterrupted availability of banking services.

- Focus on North-East: Banks have also been asked to come up with specific schemes for the North-East.

- Bad Bank: The proposed bad bank is very close to getting a licence.

- A bad bank is a bank set up to buy the bad loans and other illiquid holdings of another financial institution.

- Raising Funds Outside the Banking Sector: With changed times, now industries have the option of raising funds even from outside the banking sector.

- Banks themselves are raising funds through various avenues.

- These new aspects need to be studied to target credit where it is needed.

- Leveraging Fintech Sector: Fintech (Financial Technology), one such sector that can provide technological help to banks as well as can benefit from help from the banking sector.

- Export Promotion: Banks will be urged to work with state governments to push the ‘one district, one export’ agenda.

- About EASE Agenda:

- It was launched in January 2018 jointly by the government and PSBs.

- It was commissioned through Indian Banks’ Association and authored by Boston Consulting Group.

- Various Stages under EASE Reforms Agenda:

- EASE 1.0: The EASE 1.0 report showed significant improvement in PSB performance in resolution of Non Performing Assets (NPAs) transparently.

- EASE 2.0: EASE 2.0 was built on the foundation of EASE 1.0 and introduced new reform Action Points across six themes to make reforms journey irreversible, strengthen processes and systems, and drive outcomes. The six themes of EASE 2.0 are:

- Responsible Banking;

- Customer Responsiveness;

- Credit Off-take,

- PSBs as UdyamiMitra (SIDBI portal for credit management of MSMEs);

- Financial Inclusion & Digitalisation;

- Governance and Human Resource (HR).

- Ease 3.0: It seeks to enhance ease of banking in all customer experiences, using technology viz.

- Dial-a-loan and PSBloansin59 minutes.com.

- Partnerships with FinTechs and E-commerce companies,

- Credit@click,

- Tech-enabled agriculture lending,

- EASE Banking Outlets etc.

- Performance Under EASE Reforms Agenda:

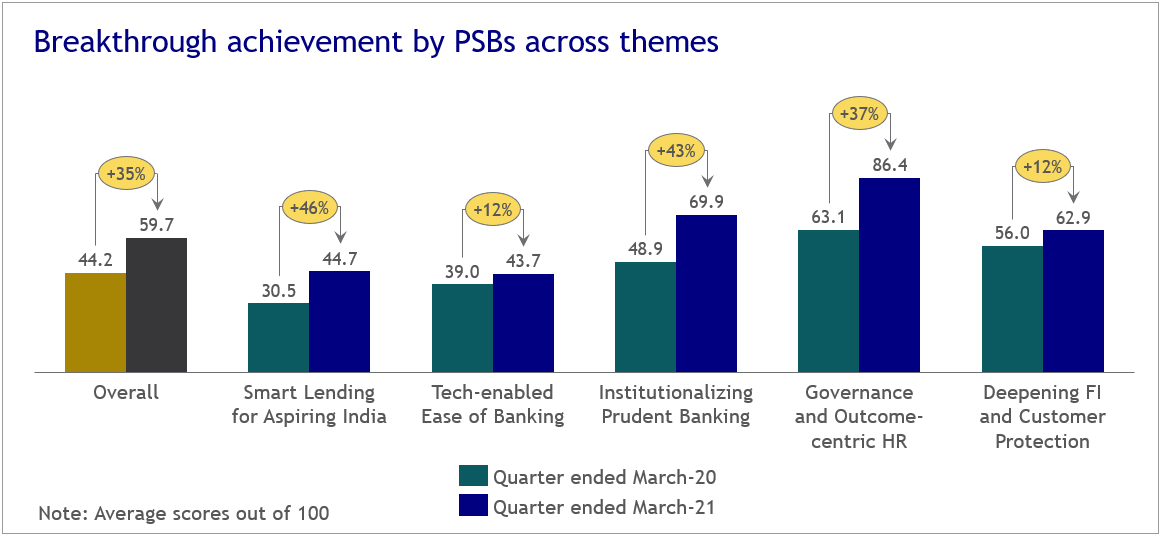

- EASE Reforms Index: The Index measures performance of each PSB on 120+ objective metrics. The goal is to continue driving change by encouraging healthy competition among PSBs.

- PSBs have done well and come out of Prompt Corrective Action (PCA) despite service extended during the pandemic.

- PCA is a framework under which banks with weak financial metrics are put under watch by the RBI.

- PSBs have recorded phenomenal growth over four quarters since the launch of EASE 3.0 Reforms Agenda in February 2020.