RBI Cuts Repo Rate

Why in News

The Reserve Bank of India has extended the moratorium on loan repayments by three more months in view of Covid-19. Further, a 40 basis points (bps) cut to both the repo and reverse repo rates has been announced.

- The decision has been taken by the RBI’s Monetary Policy Committee which met ahead of its scheduled meeting in early June.

- The latest moves are expected to ease the financial burden on businesses due to the extended lockdown.

Key Points

- Repo Rate and Reverse Repo Rate:

- Decision: The repo rate is presently at 4%, while the reverse repo rate stands at 3.35%.

- Impact: This will make funds cheaper for banks, thus aiding them to bring down loan lending rates. Repo rate is the rate at which a country’s central bank (RBI) lends money to commercial banks.

- The cut in reverse repo rate will prompt banks to lend more rather than keeping their funds with the RBI. Reverse repo rate is the rate at which the central bank of a country borrows money from commercial banks within the country.

- Extension of Moratorium on Loan Repayments by Another 3 Months:

- Decision: The lending institutions have been permitted to extend the moratorium (suspension) on term loan instalments by another three months, i.e., from 1st June, 2020 to 31st August, 2020.

- A term loan is a loan from a bank for a specific amount that has a specified repayment schedule and either a fixed or floating interest rate.

- Impact: This is expected to help borrowers, especially companies, which have halted production and are facing cash flow problems, to get more time to restart their units.

- Earlier, the RBI announced the moratorium for a three-month period — 1st March to 25th May.

- All Conditions Unchanged: All conditions related to the extension remain unchanged, that is, the loan will not be classified by the lender as a ‘non-performing asset’ and there will not be any impact on the creditworthiness of any individual/firm.

- A Non Performing Asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

- Decision: The lending institutions have been permitted to extend the moratorium (suspension) on term loan instalments by another three months, i.e., from 1st June, 2020 to 31st August, 2020.

- Conversion of Interest Charges into a Term Loan:

- The RBI has allowed borrowers and banks to convert the interest charges during the moratorium period (from 1st March to 31st August) into a term loan which can be repaid by March 2021.

- This is expected to reduce the burden on borrowers who have gone for moratorium.

- Group Exposure Limit Raised:

- The group exposure limit of banks has been increased from 25% to 30% of the capital base for a temporary period till 30th June, 2021.

- Group exposure limit determines the maximum amount a bank can lend to one business house. Under the existing guidelines on the Large Exposures Framework, the exposure of a bank to a group of connected counterparties should not be higher than 25% of its capital base.

- The decision was taken to facilitate flow of resources to the companies as many of them were unable to raise funds from capital markets and are predominantly dependent on funding from banks.

- For Boosting Foreign Trade:

- A Rs. 15,000 crore line of credit for a period of 90 days would be extended to the Exim Bank to boost the foreign trade. Export-Import (Exim) Bank is the premier export finance institution of the country.

- The maximum permissible period of pre-shipment and post-shipment export credit sanctioned by banks has been increased from the existing one year to 15 months (for loan disbursements made up to 31st July, 2020).

- This was done to help exporters support their production and realisation cycles. Simply put, any exporter who has taken credit from a bank can repay it in 15 months instead of one year.

- Views on GDP and Inflation:

- The RBI refrained from providing a Gross Domestic Product (GDP) growth forecast for the year, or likely trajectory for inflation.

- GDP growth will slip into negative territory this year, blaming it on the collapse in demand due to a fall in private consumption following the Covid-19 lockdown.

- The central bank has, however, pointed to the likelihood of some pick-up in growth impulses beginning the second half of 2020-21.

Criticism

- Some believe that the latest cut may be no more than a sentiment booster as economic activity is at its nadir (worst) and there are not many investment proposals that may benefit from the lower interest rate. Existing borrowers may be the only beneficiaries of the rate cut at this point in time.

- The smaller Non-Banking Financial Companies (NBFCs) and corporates may remain stressed, despite liquidity being provided.

- Bankers expect a spurt in Non-Performing Assets down the road as nearly six months of non-payment of debt would likely affect credit culture.

- RBI did not permit a one time restructuring of existing loans to the seriously affected sectors such as real estate, hotels etc. as demanded by banks.

Way Forward

- The stress in the economy will continue. The government can provide subvention on existing loans.

- The banks are unwilling to take risks in the current scenario. Thus, there is a need to remove risk averseness in the financial system.

ReStart Programme for MSMEs

Why in News

Recently the Chief Minister of Andhra Pradesh has launched a new programme ‘ReStart’ to support the Micro, Small and Medium Enterprise (MSME) sector in the State.

Key Points

- The Package: The government will spend ₹1,100 crore on revival of the sector which is expected to benefit 98,000 units that provide employment to more than 10 lakh people.

- Special Fund: A special fund of ₹200 crore to provide input capital loan to the firms at low interest rates.

- Waiving Off Power Charges: The minimum power demand charges of the MSMEs for the months of April, May and June, amounting to ₹188 crore to be waived off.

- Mandatory Purchasing by Government: The government will purchase around 360 products from the MSMEs, and payments towards it would be cleared in 45 days.

- Of the total purchases, almost 25% would be done from the micro and small enterprises, 4% from the SC/ST community enterprises, and 3% from women entrepreneurs.

- Capacity Development: Skills required by the industries (MSMEs) to be imparted through Skill Development Colleges.

Importance of MSMEs for Indian Economy

- Employment: It is the second largest employment generating sector after agriculture. It provides employment to around 120 million persons in India.

- Contribution to GDP: With around 36.1 million units throughout the geographical expanse of the country, MSMEs contribute around 6.11% of the manufacturing GDP and 24.63% of the GDP from service activities.

- The MSME ministry has set a target to up its contribution to GDP to 50% by 2025 as India becomes a $5 trillion economy.

- Exports: It contributes around 45% of the overall exports from India.

- Inclusive growth: MSMEs promote inclusive growth by providing employment opportunities in rural areas especially to people belonging to weaker sections of the society.

- For example: Khadi and Village industries require low per capita investment and employ a large number of women in rural areas.

- Financial inclusion: Small industries and retail businesses in tier-II and tier-III cities create opportunities for people to use banking services and products.

- Promote innovation: It provides opportunity for budding entrepreneurs to build creative products boosting business competition and fuels growth.

Problems Faced by MSMEs in India

- Too Small to get Registered: Being out of the formal network, these MSMEs do not have to maintain accounts, pay taxes or adhere to regulatory norms etc., which brings down their costs. But in a time of crisis, it also constrains a government’s ability to help them.

- Lack of Financing: According to a 2018 report by the International Finance Corporation (part of the World Bank), the formal banking system supplies less than one-third (or about Rs 11 lakh crore) of the MSME credit need that it can potentially fund.

- Delays in Payments to MSMEs: MSMEs face delays in payment from their buyers which also includes the government. It also faces delays in GST refunds.

Revised definition for MSME

- Under the new MSME Classification MSMEs will now be defined in a composite manner, taking both investments as well as turnover into account.

- Micro: Any firm with investment up to Rs 1 crore and turnover under Rs 5 crore.

- Small: Any firm with investment up to Rs 10 crore and turnover upto Rs 50 crore.

- Medium: Any firm with investment up to Rs 20 crore and turnover under Rs 100 crore.

Way Forward

- Along with the Atma Nirbhar Bharat Abhiyan package of the Central Government, the ReStart Programme will further provide much needed relief to the people engaged in this sector. Other States may also follow in the true spirit of cooperative and competitive federalism in order to support the backbone of Indian Economy.

- Further, the government can provide tax relief, give swifter refunds, and provide liquidity to rural India to boost demand for MSME products.

Plan for Calamity Cess on GST

Why in News

The Central Government is considering imposing a calamity cess on Goods and Services Tax (GST), similar to the one introduced by Kerala in 2019, to deal with the economic crisis triggered by the coronavirus pandemic.

- The Central government is planning to raise additional revenue by imposing cess on GST, excluding goods and services in the 5% slab.

Key Points

- Kerala introduced a disaster relief cess following the monsoon floods of 2018. It imposed a 1% calamity cess on GST for a period of two years applicable from 1st August, 2019.

- It is the only state to have levied such a cess using the Constitutional provision, Section (4) (f) of Article 279 A.

- Article 279A (4)(f) allows the Union and State to raise additional resources during any natural calamity or disaster.

- The article was inserted through the 101st Constitutional Amendment Act, 2016.

- Article 279A (4)(f) specifies that the GST Council shall make recommendations to the Union and the States on “any special rate or rates for a specified period to raise additional resources during any natural calamity or disaster”.

- Article 279A (4)(f) allows the Union and State to raise additional resources during any natural calamity or disaster.

- The GST (Compensation to States) Act, 2017 also provides for the imposition of cess up to the rate of 15% ad valorem (based on estimated value) on some supplies.

- The Act provides for compensation to states for any loss in revenue due to the implementation of GST.

- Issues involved:

- As the manufacturing industry is already facing a huge crisis due to Covid-19 lockdown, imposing cess on GST would not be a good idea.

- Imposition of cess will increase the cost of products, which may decrease the demand.

- The states are already not able to collect the GST due to closure of many economic activities.

- As the manufacturing industry is already facing a huge crisis due to Covid-19 lockdown, imposing cess on GST would not be a good idea.

Cess

- Cess is a form of tax levied over and above the base tax liability of a taxpayer. It can be levied on both indirect and direct taxes.

- A cess is usually imposed additionally when the state or the central government looks to raise funds for specific purposes. For example, for education, for disaster relief, for cleaning rivers etc.

- An example of cess is Swachh Bharat Cess, which was introduced in 2015 to fund a national campaign for clearing the roads, streets and the infrastructure of India.

- It is not a permanent source of revenue for the government, and it is discontinued when the purpose of levying it is fulfilled.

Difference between tax and cess

- Cess is different from taxes such as income tax, GST, and excise duty etc. as it is charged over and above the existing taxes.

- Cess has to be used for the purpose for which it was collected.

- If the cess collected in a particular year goes unspent, it cannot be allocated for other purposes. The amount gets carried over to the next year and can only be used for the cause it was meant for.

- The central government does not need to share the cess with the state government, unlike some other taxes.

- The procedure for introducing, modifying and abolishing cess is comparatively simpler than getting the provisions done for introducing, modifying and abolishing taxes, which usually means a change in the law.

Way Forward

- Additional cess on GST can be imposed after 6-7 months, when the economic condition in the country normalises.

- Till then, the states can rely on other monetary instruments, such as borrowing, increase in Ways and Means Advances (WMA), overdraft, etc, to raise their income.

- They can also consider levying a cess on “sin goods”.

- Sin goods are goods which are considered harmful to society and individuals.

- Example of sin goods: Alcohol and Tobacco, Candies, Drugs, Soft drinks, Fast foods, etc.

India-Nepal Border Dispute

Why in News

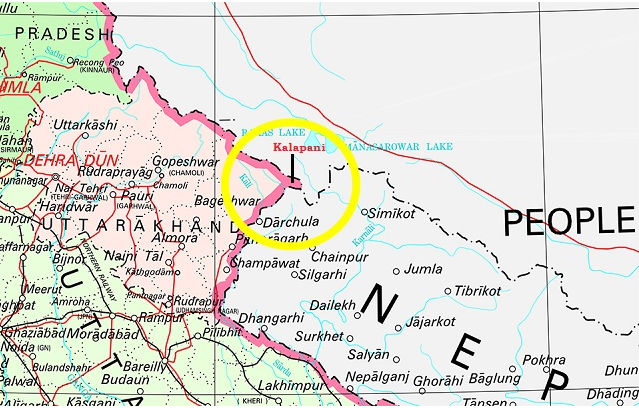

Recently, Nepal has released a new political map that claims Kalapani, Limpiyadhura and Lipulekh of Uttarakhand as part of Nepal’s territory. The area of Susta (West Champaran district, Bihar) can also be noted in the new map.

Key Points

- India rejected the new map of Nepal saying that Nepal's new map involves artificial enlargement of territories, which is not based on historical facts and evidence.

- Nepal’s act is an unilateral act and is contrary to the bilateral understanding to resolve the outstanding boundary issues through diplomatic dialogue.

- India has urged the Government of Nepal to refrain from such an unjustified cartographic assertion and respect India’s sovereignty and territorial integrity.

- India has also asked Nepal to return to dialogue.

- Nepal’s move came after India’ Defence Minister recently inaugurated a motorable link road that connects India and China, significantly reducing the time of Kailash Mansarovar Yatra.

- The road passes through territory at the Lipulekh pass that Nepal claims as its own territory.

- Earlier, Nepal had protested strongly against India, when India published a new map which showed the region of Kalapani as part of the Indian territory.

- Nepal had also expressed displeasure on the 2015 agreement between India and China for using the Lipulekh pass for trade, without consulting Nepal.

Border Dispute Between India and Nepal

- Currently, India and Nepal have border disputes over Kalapani - Limpiyadhura - Lipulekh trijunction between India-Nepal and China and Susta area (West Champaran district, Bihar).

- Kalapani Region:

- Kalapani is a valley that is administered by India as a part of the Pithoragarh district of Uttarakhand. It is situated on the Kailash Mansarovar route.

- Kalapani is advantageously located at a height of over 20,000 ft and serves as an observation post for that area.

- The Kali River in the Kalapani region demarcates the border between India and Nepal.

- The Treaty of Sugauli signed by the Kingdom of Nepal and British India (after Anglo-Nepalese War) in 1816 located the Kali River as Nepal's western boundary with India.

- The discrepancy in locating the source of the Kali river led to boundary disputes between India and Nepal, with each country producing maps supporting their own claims.

- Kalapani is a valley that is administered by India as a part of the Pithoragarh district of Uttarakhand. It is situated on the Kailash Mansarovar route.

- Susta Region:

- The change of course by the Gandak river is the main reason for disputes in the Susta area.

- Susta is located on the bank of the Gandak river.

- It is called Narayani river in Nepal.

- It joins Ganga near Patna, Bihar.

- Nepal’s Stand:

- Kali river originates from a stream at Limpiyadhura, north-west of Lipu Lekh. Thus Kalapani, and Limpiyadhura, and Lipu Lekh, fall to the east of the river and are part of Nepal’s Dharchula district.

- Lipulekh was deleted from the country’s map by the kings to get favours from India.

- The territory of Kalapani was offered to India by King Mahendra after the 1962 India-China war who wanted to help India’s security concerns due to perceived lingering Chinese threats.

- Kalapani was not a part of Nepal-India dispute. It was Nepal’s territory that the king had allowed India to use temporarily

- The new map is in fact a document that was in circulation in Nepal till the 1950s.

- India’s Stand:

- Kali river originates in springs well below the Lipu-lekh pass, and the Sugauli Treaty does not demarcate the area north of these streams.

- The administrative and revenue records of the nineteenth century also show that Kalapani was on the Indian side, and counted as part of Pithoragarh district of Uttarakhand.

- Efforts to Solve Border Dispute:

- In the 1980s, the two sides set up the Joint Technical Level Boundary Working Group to delineate the boundary.

- The group demarcated everything except Kalapani and Susta area.

- Officially, Nepal brought the issue of Kalapani before India in 1998. Both sides agreed to demarcate the outstanding areas (including Kalpani) by 2002 at the prime ministerial level talk held in 2000. But that has not happened yet.

- In the 1980s, the two sides set up the Joint Technical Level Boundary Working Group to delineate the boundary.

- Issues Involved:

- Nepal's deliberate effort to make the Lipu-Lekh Pass a disputed tri-junction (between India-China and Nepal) in which Nepal has an equal share.

- India perceives Nepal to be tilting towards China under the leadership of Prime Minister K P Oli and his Nepal Communist Party.

- Despite the open border between both countries and the people to people contact, the levels of distrust in Nepal about India have only increased.

Way Forward

- Given the importance of ties with Nepal, often romanticised as one of “roti-beti” (food and marriage), India must not delay dealing with the matter, and at a time when it already has a faceoff with China in Ladakh and Sikkim.

- Since the free movement of people is permitted across the border, Nepal enjoys immense strategic relevance from India’s national security point of view, as terrorists often use Nepal to enter India.

- Therefore, stable and friendly relations with Nepal is one of prerequisites which India can’t afford to overlook.

- India should also try to convey to Nepal’s leadership about the congenial and friendly environment that 6 to 8 million Nepali citizens living in India enjoy.

- Therefore, Any thoughtless erosion of this centuries old togetherness may prove difficult for both countries.

- The existing bilateral treaties between India and Nepal have not taken the shifting of Himalayan rivers into consideration. A primary reason for this is the lack of an approach where ecological concerns and needs of rivers are often discussed.

- Therefore, India and Nepal should try to resolve the boundary dispute by taking into account all shared environmental characteristics.

Increased Chinese Transgression

Why in News

Recently, there has been a marked increase in the number of Chinese transgressions across the disputed India-China border in Ladakh.

- In Ladakh, a surge of 75% have been observed in 2019 compared to 2018 and the first four months of 2020 have also witnessed an increase compared to 2019.

Key Points

- Chinese Transgression:

- The border between India and China is not fully demarcated and the Line of Actual Control (LAC) is neither clarified nor confirmed by the two countries.

- This leads to different perceptions of the LAC for the two sides while soldiers from either side try to patrol the area.

- Observation Methods: Use of surveillance equipment, face-offs by patrols, reliable indications by locals, or evidence left by the Chinese in the form of wrappers, biscuit packets etc. in an unmanned area.

- Official data shows that 80% of Chinese transgressions across the LAC since 2015 have taken place in four locations of which three are in eastern Ladakh in the western sector.

- These areas of eastern Ladakh are Pangong Tso, Trig Heights and Burtse.

- The fourth area is the Dichu Area/Madan Ridge area (Arunachal Pradesh) of the Eastern sector.

- Implications of Increased Number of Transgressions:

- It is an indicator of increased Chinese assertiveness.

- Even if there are no major incidents, it should not be taken lightly.

- So far, there has been no major standoff between the two sides after the 73-day Doklam standoff on Sikkim-Bhutan border in 2017.

Different Sectors of India-China Border

- India and China share a boundary that stretches 3,488 km from Ladakh to Arunachal Pradesh.

- The border dispute still stands unresolved.

- It is divided into three sectors:

- Western Sector: It falls in the Union Territory (UT) of Ladakh and is 1597 km long.

- It witnesses the highest transgressions between the two sides.

- Middle Sector: It falls in Uttarakhand and Himachal Pradesh and is 545 km long.

- It is the least disputed sector between the two countries.

- Eastern Sector: It falls in the states of Sikkim and Arunachal Pradesh and is 1346 km long.

- Western Sector: It falls in the Union Territory (UT) of Ladakh and is 1597 km long.

Concerns

- India is worried about the tensions at Naku La in Sikkim and at Galwan river and Pangong Tso in Ladakh.

- The increased transgressions lead to more tensions between both countries which are already struggling to contain the Covid-19 pandemic.

- Nepal’s recent behaviour on the Mansarovar Link Road raising the border map issue also raises Indian concerns.

- The constant accusations on each other also cause tensions and disrupt the peace on borders.

- Recently, Chinese media accused India of building defence facilities in the Galwan Valley region of the contested Aksai Chin area.

- India and China are both nuclear-armed countries with strong militaries and the constant border conflicts are not a desirable thing.

Way Forward

- In the Wuhan and Mahabalipuram summits, both China and India had reaffirmed that they will make efforts to ensure peace and tranquility in the border areas.

- On 1st April, 2020 India and China completed their 70 years of diplomatic relations.

- Both countries have resolved border issues peacefully in the past four decades which gives the hope that the tensions will subside soon.

- Establishment of peace between the two big powers of such an important geopolitical region is essential for their own growth and development as well as for maintenance of global peace.

New Security Law in Hong Kong

Why in News

Recently, a draft legislation on national security has been tabled before China’s Parliament which will allow Beijing to draft national security laws for Hong Kong and also operate its national security organs in it.

- It will make changes in the Basic Law, the mini-constitution which defines ties between Hong Kong and Beijing (China’s capital).

Key Points

- Basic Law allows Hong Kong to enjoy executive, legislative and independent judicial power, including that of final adjudication, barring matters of defence and foreign affairs.

- Under Article 23 of the Basic Law, Hong Kong has to enact a national security law “to prohibit any act of treason, secession, sedition, subversion against the Central People’s Government, or theft of state secrets, to prohibit foreign political organizations or bodies from conducting political activities in the Region, and to prohibit political organizations or bodies of the Region from establishing ties with foreign political organizations or bodies.”

- Article 23 aims at preserving national security but it will also allow China’s national security organs to formally operate and set up institutions in Hong Kong.

- Basic law makes it clear that only Hong Kong’s Legislative Council (LegCo) can make and repeal laws.

- Beijing wants LegCo to pass the new legislation as soon as possible because it is afraid that if LegCo comes under the control of democrats after elections later in 2020, it will be hard to implement the legislation.

- Democrats are against this law as it curbs the autonomy of Hong Kong as SAR.

- However, Beijing can bypass LegCo if it chooses to and make the national security law applicable to Hong Kong by inserting this legislation in Annex III of the Basic Law.

- Under Article 18 of Basic Law, national laws can be applied in Hong Kong if they are placed in Annex III, and must be confined to defence, foreign affairs and matters outside the limits of autonomy of the region.

- Once listed in Annex III, national laws can be enforced in the city by way of promulgation (automatically being put into effect) or by legislating locally in the SAR.

Basic Law

- Hong Kong was formerly a British colony and was handed over to mainland China in 1997, becoming one of its Special Administrative Regions (SAR).

- It is governed by a mini-constitution called the Basic Law, which affirms the principle of “one country, two systems”.

- The constitutional document is a product of the 1984 Sino-British Joint Declaration, under which China promised to honour Hong Kong’s liberal policies, system of governance, independent judiciary, and individual freedoms for a period of 50 years from 1997.

Background

- Since 1997, Hong Kong residents have protested many times to protect their Basic Law freedoms.

- In 2003, the first major pro-democracy protest took place when the Hong Kong government first tried to enact the national security law.

- In 2014, over one lakh city residents took part in the Umbrella Revolution to protest against China’s denial of democratic reforms.

- In 2019, the largest protest till now, took place against a proposed extradition law, and continued with pro-democracy marches even after the legislation was withdrawn.

- Impact of the Protests:

- The protests were seen as an affront by mainland China after which the government started adopting a more hardline approach to foreign policy and internal security issues.

- The Hong Kong unrest also impacted Taiwan which led to the victory of the Democratic Progressive Party, which openly opposes joining China.

- China considers the island states as its own but Taiwan opposes the view.

Criticism

- The draft law has been criticised by democratic parties in Hong Kong as it undermines the “one country, two systems” model that gives the SAR a high degree of autonomy.

- Hong Kong’s freedoms will be compromised as the law could effectively bring the city under full control of mainland China.

- The new law would ban seditious activities that target mainland Chinese rule, as well as punish external interference in Hong Kong affairs. This will lead to the revival of the protests.

Way Forward

- Recent protests against the extradition law questioned the secretive, authoritarian and coercive government system of China which believes that people can be controlled all the time. These also spreaded in the UK, France, US, Canada and Australia gathering global attention and support.

- The move to enact the national security law could also undermine Hong Kong’s position as an East Asian trading hub, and invite global disapproval for Beijing, which is already being accused of withholding key information related to the Covid-19 pandemic.

- It becomes crucial to see how Hong Kong deals with the situation. The freedoms granted to it under the Basic Law will expire in 2047 and it is not clear what Hong Kong’s status will be.

Open Skies Treaty

Why in News

Recently, the United States of America (USA) has announced that it will exit the Open Skies Treaty (OST) due to continuous violation of the treaty by Russia and changes in the security environment.

Key Points

- It is expected to formally pull out of Open Skies in six months.

- USA’s Stand: The USA has blamed Russia for restricting US flyovers in neighbour Georgia and its military enclave in Kaliningrad (Russia).

- Russia misused its flights over the US and Europe to identify critical infrastructure for potential attack in a time of war.

- Russia intends to annex the Crimean peninsula and has designated an Open Skies refueling airfield in the region.

- Yet, the USA has expressed willingness to make a new agreement.

- Russia’s Stand: Russia has denied the allegations and warned that the withdrawal will affect the interests of all of 35 participating countries.

- However, Russia intended to fully follow all the rights and obligations under the treaty as long as the treaty is in force.

- It can be noted that the USA has used the treaty more intensively than Russia.

- Between 2002 and 2016, the U.S. flew 196 flights over Russia compared to the 71 flights flown by Russia.

- This move by the USA has further deepened doubts on extension of the New START treaty, which expires in February, 2021.

- Throughout its term, the Trump administration has been skeptical of arms control agreements. In 2019, the U.S. and Russia walked away from the 1987 Intermediate-Range Nuclear Forces Treaty.

Open Skies Treaty

- It was signed in 1992 and came into effect in 2002.

- It is an agreement that allows its 34 signatories countries to monitor arm development by conducting surveillance flights (unarmed) over each other’s territories.

- Therefore, the treaty established an aerial surveillance system for its participants.

- Both US and Russia are signatories of the treaty.

- India is not a member of this treaty.

Intermediate-Range Nuclear Forces Treaty

- It was a nuclear arms-control accord reached by the United States and the Soviet Union in 1987 in which the two nations agreed to eliminate their stocks of intermediate-range and shorter-range (or “medium-range”) land-based missiles (which could carry nuclear warheads).

- It also covered all land-based missiles, including those carrying nuclear warheads but did not cover sea-launched missiles.

- The United States withdrew from the Treaty on 2nd August 2019.

New START Treaty

- The new Strategic Arms Reduction Treaty (START) is a treaty between the United States of America and the Russian Federation on measures for the further reduction and limitation of strategic offensive arms.

- It entered into force on 5th February, 2011.

- It is a successor to the START framework of 1991 (at the end of the Cold War) that limited both sides to 1,600 strategic delivery vehicles and 6,000 warheads.

- The USA has been worried that extending New Start would negatively impact an arms deal with China and Russia.

- It is concerned that China’s nuclear stockpile could be doubled if the New Start Treaty continued as is, without including China.

- The New Start Treaty also suffered from verification inadequacies and that the U.S. intended to establish a new arms control regime which would include China.

Relaxation for Limited Category of OCIs

Why in News

The Ministry of Home Affairs has relaxed the Visa and travel restrictions for a limited category of stranded Overseas Citizen of India (OCI) cardholders to come to the country.

Key Points

- The life-long visa to OCIs was temporarily suspended in March in the wake of Covid-19 pandemic.

- Several OCIs were feeling discriminated against as it stopped them from flying to India on the special flights being arranged by the government under the Vande Bharat scheme.

- The categories allowed by the MHA on include:

- Minors born to Indian nationals abroad and holding OCI cards,

- Those who wish to come to India on account of family emergencies.

- Couples where one spouse is a cardholder and the other is an Indian national and they have a permanent residence in India.

- University students who are cardholders (not legally minors) but whose parents are Indian citizens living in India.

Overseas Citizenship of India Scheme

- A Committee on the Indian Diaspora under the Chairmanship of L.M. Singhvi, in 2002 recommended the amendment of the Citizenship Act (1955) to provide for grant of dual citizenship to the Persons of Indian Origin (PIOs) belonging to certain specified countries.

- Accordingly, the Citizenship (Amendment) Act, 2003, made provision for acquisition of Overseas Citizenship of India (OCI) by the PIOs of 16 specified countries other than Pakistan and Bangladesh.

- Later, the Citizenship (Amendment) Act, 2005, expanded the scope of grant of OCI for PIOs of all countries except Pakistan and Bangladesh as long as their home countries all dual citizenship under their local laws.

- It must be noted here that the OCI is not actually a dual citizenship as the Indian Constitution forbids dual citizenship or dual nationality (Article 9).

- OCI does not confer political rights.

- The registered Overseas Citizens of India shall not be entitled to the rights conferred on a citizen of India under article 16 of the Constitution with regard to equality of opportunity in matters of public employment.

- The Citizenship (Amendment) Act, 2015, replaced the nomenclature of “Overseas Citizen of India” with that of “Overseas Citizen of India Cardholder”.

- The OCI scheme provides facilities like life-long visa, exemption from registration with Foreigners Regional Registration Office and parity with NRIs in economic, financial and educational fields except purchase of agricultural properties, political and public employment rights.

Covid-19 Halts Global Vaccination Programme

Why in News

As per the report released by the World Health Organisation (WHO) and partners, nearly 80 million children under the age of 1 are at risk of contracting deadly but vaccine preventable diseases such as measles, polio and diphtheria.

- This is so because many countries have postponed their vaccine campaigns due to Covid-19.

- The report has come ahead of the Global Vaccine Summit on 4th June, at which world leaders are expected to come together to help maintain immunization programmes and mitigate the impact of the pandemic in lower-income countries.

- The Summit will provide an opportunity for the international community to pledge its support for Gavi’s five-year strategy (2021-2025) which is aimed at immunizing 300 million children and saving up to 8 million lives.

- The United Nations Children's Fund (UNICEF), the Sabin Vaccine Institute (Washington, USA), and Global Alliance for Vaccines and Immunizations (Gavi), are the partner organisations.

Key Points

- Data:

- More than half (53%) of the 129 countries where data were available reported moderate-to-severe disruptions, or a total suspension of vaccination services during March-April 2020.

- Reasons for the disruption:

- Vaccination, which is typically done in mass campaigns, has been stopped due to fear of breaking social distancing guidelines needed to stop the spread of Covid-19.

- Health workers who provide vaccinations have also been diverted to help with the response to the pandemic.

- Also, there has been a significant delay in planned vaccine deliveries due to lockdown measures and reduction in the number of available flights.

- More than 40 of Africa's 54 nations have closed their borders, though some allow cargo and emergency transport.

- Concerns:

- Disruption to immunization programs from the Covid-19 pandemic threatens to undo decades of progress against vaccine-preventable diseases like Measles, Polio and Diphtheria.

- According to the experts, children need routine immunizations before the age of 2.

Immunization

- It is the process whereby a person is made immune or resistant to an infectious disease, typically by the administration of a vaccine.

- Functioning:

- A vaccine usually consists of two parts and is usually given through an injection. The first part is the antigen, which is a piece of disease one’s body must learn to recognise. The second part is the adjuvant, which sends a danger signal to the body and helps the immune system to respond strongly against the antigen.

- In simple terms, vaccines work by exposing a person to a safer version of a disease. While the body responds to the vaccine, it builds an adaptive immune system, which helps the body to fight off the actual infection in the future.

- According to the WHO, vaccination prevents between two-three million deaths each year, a figure that will rise by another 1.5 million if vaccine coverage improves.

Way Forward

- There is an urgent need to focus upon the Global Vaccine Action Plan 2011-2020 that is a framework to prevent millions of deaths by 2020 through more equitable access to existing vaccines for people in all communities.

- It is equally important for the countries to give importance to the United Nations Sustainable Development Goal 3 i.e. Good Health and Well being.

- There is a need for an immediate action plan to restart the vaccination programmes through better health infrastructure and medical equipment during the corona crisis.

- Countries should start efforts at individual level e.g. India can expedite the vaccination programmes under the Mission Indardhanush.