Special Protection Group (Amendment) Bill, 2019

Why in News

Recently, the Parliament has passed the Special Protection Group (Amendment) Bill, 2019. The SPG Bill will amend the SPG Act of 1988.

- The proposed amendments in the Special Protection Group (SPG) Bill aims to reduce the financial burden of VIP security on the state exchequer.

- The reduction of SPG coverage will also help to eliminate the notion of a status symbol attached to it.

Special Protection Group

- The SPG was raised in 1985 to provide security cover to the Prime Minister, former Prime Ministers and their immediate family members.

- The SPG comprises of the personnel from the CRPF, Border Security Force and other Central and State forces.

Amendments

- Reduced SPG Coverage:

- The protection to be offered only to the Prime Minister, former Prime Ministers and their immediate family members that will reside with him at his official residence.

- Currently, the security cover is provided to the Prime Minister, former Prime Ministers and their immediate family members.

- Time period:

- The security will be provided only for a period of five years to the former Prime Ministers and their immediate family after they leave the office.

- However, the immediate family members need to be residing with the former Prime Minister at the allotted residence.

- Withdrawal:

- When the proximate security is withdrawn from a former Prime Minister such proximate security will also stand withdrawn from members of his immediate family.

GST Compensation

Why in News

The GST Council has informed all the States that the central government might not be able to compensate them for losses arising out of the implementation of the Goods and Services Tax (GST).

- The GST Council is a Constitutional body chaired by the Union Finance Minister and comprises the Minister of State for Finance/ Revenue and finance ministers of all States.

- It makes recommendations on all important issues related to the Goods and Services Tax.

Background

- The GST became applicable from 1st July 2017 after the enactment of the 101st Constitution Amendment Act, 2016. With GST, a large number of central and state indirect taxes merged into a single tax.

- The Centre promised compensation to the States for any shortfall in tax revenue due to GST implementation for a period of five years. This promise convinced a large number of reluctant States to sign on to the new indirect tax regime.

- As per the GST Act, states are guaranteed compensation for any revenue shortfall below 14% growth (base year 2015-16) for the first five years ending 2022. GST compensation is paid out of Compensation Cess every two months by the Centre to states.

- The Compensation Cess is a cess that will be collected on the supply of select goods and or services or both till 1st July 2022.

- All the taxpayers, except those who export specific notified goods and those who have opted for GST composition scheme, are liable to collect and remit the GST compensation cess to the central government.

- Subsequently, the central government distributes it to the states.

- The Centre has already delayed compensating states for the shortfall in GST revenues for August-September 2019, payment for which was due in October, 2019. At least five states/UTs – Kerala, West Bengal, Delhi, Rajasthan and Punjab issued a joint statement on 20th November 2019 raising concerns about the same.

Key Points

- Revenue Status: The government budgeted for ₹6,63,343 crore in GST collections for the current financial year 2019-20, out of which it has collected only about 50% in the first eight months. It targeted ₹1,09,343 crore of compensation cess collections, of which it has so far collected ₹64,528 crores.

- Compensation Status

- The Centre collected Rs 64,528 crore in compensation cess during April-November, 2019 and paid out Rs 45,744 crore for April-July period.

- It has been reported that the payments were held back to the states for August - September in anticipation of the shortfall in collections and the resultant impact on the government’s fiscal deficit.

- The GST Council has also asked states to give their inputs and proposals regarding review of items under the exemption, GST and compensation cess rates on various items among others by 6th December 2019.

- Given that cess is imposed only on luxury and sin goods under GST, any measure to generate more cess collections would either include imposing a higher cess on those items or tinkering at the highest tax slab of 28% under the GST regime.

Impact

- A shortfall in Centre’s tax receipts hurts states more since the absolute amount they receive as per the devolution formula takes a hit.

- At a time when growth is faltering, the delays in paying compensation to states as guaranteed by the GST Act will make it more difficult for them to meet their own finances.

Way Forward

- There is a need to boost the economic growth of the country.

- The Government needs to think about the ways through which it can increase GST collections.

International Day of Persons with Disabilities

Why in News

International Day of Persons with Disabilities was celebrated worldwide on 3rd December 2019.

Key Points

- It was proclaimed in 1992 by United Nations General Assembly resolution 47/3.

- The Convention on the Rights of Persons with Disabilities (CRPD) was adopted in 2006. It has further advanced the rights and well-being of persons with disabilities in the implementation of the 2030 Agenda for Sustainable Development and other international development frameworks.

Significance

- It aims to promote the rights and well-being of persons with disabilities in all spheres of society and development and to increase awareness of the situation of persons with disabilities in every aspect of political, social, economic and cultural life.

Theme for 2019

- Promoting the participation of persons with disabilities and their leadership: taking action on the 2030 Development Agenda.

- This year it focuses on the empowerment of persons with disabilities for inclusive, equitable and sustainable development as anticipated in the 2030 Agenda for Sustainable Development, which pledges to ‘leave no one behind’ and recognizes disability as a cross-cutting issues, to be considered in the implementation of its 17 Sustainable Development Goals (SDGs).

The United Nations Disability Inclusion Strategy

- The United Nations launched it in June 2019 in line with its commitment to make the UN an inclusive organization for all.

- It provides for the foundation for sustainable and transformative progress on disability inclusion through all pillars of the work of the United Nations.

- India also celebrated the International Day of Persons with Disabilities. Vice President of India presented the National Awards for the Empowerment of Persons with Disabilities and suggested measures to improve facilities for their holistic development.

Steps Taken by the Government

- Article 41 of the Directive Principles of State Policy (DPSP) states that State shall make effective provision for securing the right to work, to education and to public assistance in cases of unemployment, old age, sickness, and disablement, within the limits of its economic capacity and development.

- Right of Persons with Disabilities Act, 2016

- This act defines disability based on an evolving and dynamic concept.

- Under the act, the types of disabilities have been increased from 7 to 21. In addition, the Government has been authorized to notify any other category of specified disability.

- The act is implemented by the Ministry of Social Justice & Empowerment.

- Deendayal Disabled Rehabilitation Scheme (DDRS)

- Scheme of Assistance to Disabled Persons for purchase/fitting of Aids/appliances (ADIP Scheme)

- Scheme for Implementation of Persons with Disabilities (Equal Opportunities, Protection of Rights and Full Participation) Act, 1995 (SIPDA)

- District Disability Rehabilitation Centres (DDRC)

- Accessible India Campaign

- Other Scholarship Schemes

Steps Needed

- Society should be inclusive and sensitive towards the needs of differently-abled.

- Creation of accessible infrastructure should be of paramount importance.

- Schools must inculcate sensitivity towards disability among children early in their lives.

- Safety at road and workplace should be enhanced for the prevention of debilitating accidents.

- Social attitude towards disability should be changed.

- Good cinema should be encouraged on the topic of disability.

Swedish Technology to Reduce Stubble Burning

Why in News

The pollution from stubble burning in winter is a major factor for the sharp decline in air quality in Delhi. To overcome this issue, India is testing Swedish technology — torrefaction that can convert rice stubble into ‘bio-coal’.

- The government has funded a pilot project at the National Agri-Food Biotechnology Institute in Mohali (Punjab) with a Swedish company to evaluate the feasibility of the technology.

Torrefaction Technology - Stubble to Bio-coal

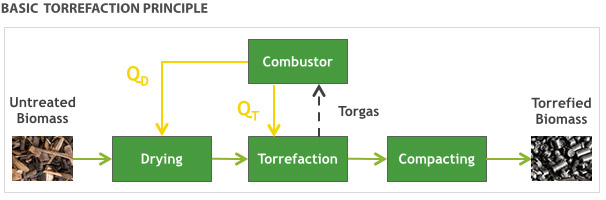

- Torrefaction is a thermal process to convert biomass into a coal-like material, which has better fuel characteristics than the original biomass.

- The process involves heating up straw, grass, sawmill residue and wood biomass to 250 degrees celsius - 350 degrees celsius.

- This changes the elements of the biomass into ‘coal-like’ pellets. These pellets can be used for combustion along with coal for industrial applications like steel and cement production.

Advantages

- The project has a capacity of converting 150-200 kilograms of paddy straw to bio-coal every hour and reduce CO2 emissions by 95%.

- Torrefied biomass is more brittle, making grinding easier and less energy-intensive.

- Compared to fresh biomass, storage of the torrefied material can be substantially simplified since biological degradation and water uptake is minimized.

- The torrefied pellets are ideal for coal replacement because it has lower shipping and transport costs, lower sulfur and ash content (compared with coal), etc.

Disadvantages

- The volume of torrefied biomass is reduced only slightly, ~ 10-20% lower than the dried feedstock during the process.

- Despite higher calorific values, energy density is not improved significantly.

- Torrefaction does not reduce corrosion of machinery especially boiler tubes.

Bio-coal

- Bio-coal, also commonly referred to as synthetic coal, is created through the torrefaction of biomass.

- The bio-coal has similar characteristics to traditional fossil-based coal, and thus viable option to reduce greenhouse gas emissions.

Anaemia in Indian Children

Why in News

A paper published in ‘Scientific Reports’ pointed out that about 58.5% of children below five years of age in India are anaemic.

- Over one lakh children were analyzed using the National Family Health Survey (2015-16) data.

- Socio-demographic factors such as the wealth of the family, maternal education, maternal age, type of residence are the main reasons behind the incidence of childhood anaemia.

- Recently, a ‘Lancet Global Health report’ also revealed that 23% of Indian men suffer from anaemia.

Anaemia

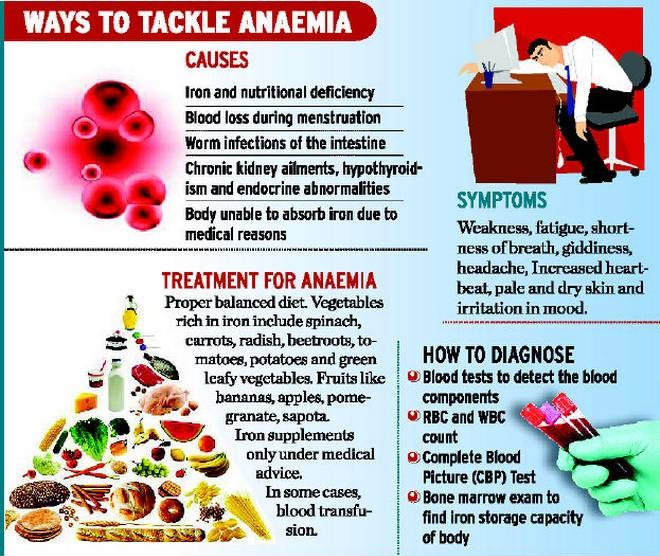

- The World Health Organization (WHO) defines anaemia as a condition in which the number of red blood cells or their oxygen-carrying capacity is insufficient to meet physiological needs.

- Iron deficiency is the most common cause of anaemia, although other conditions, such as folate, vitamin B12 and vitamin A deficiencies, chronic inflammation, parasitic infections, and inherited disorders can all cause anaemia.

- In its severe form, it is associated with fatigue, weakness, dizziness and drowsiness. Pregnant women and children are particularly vulnerable.

Key Findings

- Maternal Education

- Maternal education increases the chances of mothers being aware of different health issues and thus taking the correct and appropriate steps towards preventing such issues.

- There exists an inverse relationship between the mother's education and the incidence of childhood anaemia. In other words, as the mother’s education level increases, the tendency of the child to be anaemic decreases significantly.

- Wealth of the Family

- 52.9% of children in rich households were marked anaemic.

- The number was 63.2% in the poorest households.

- This suggests that a large number of children in poor households are anaemic, though the situation in rich households is also not that well.

- Maternal Age

- There exists an inverse relationship between the age of mothers and the incidence of anaemia in children. The children of younger mothers are more anaemic.

- This reveals the powerlessness of mothers in the age group 15-19 years in ensuring that the children get the right food.

- This also reveals the power dimension in the allocation and use of resources in the household.

Indian Programmes Related to Anaemia

- In 2018, the government of India launched Anaemia Mukt Bharat (AMB) as part of the Intensified National Iron Plus Initiative (NIPI) Program for accelerating the annual rate of decline of anaemia from one to three percentage points.

- The target groups for AMB are Children (6-59 months, 5-9 years), Adolescent Girls & Boys (10-19 years), Women of Reproductive Age (15-49 years), Pregnant Women and Lactating Mothers.

- The Ministry of Health and Family Welfare has also launched the Weekly Iron and Folic Acid Supplementation (WIFS) Programme to meet the challenge of high prevalence and incidence of anaemia amongst adolescent girls and boys.

- Other programmes introduced include Integrated Child Development Scheme (ICDS), National Nutritional Anemia Control Program (NNACP), etc to combat anemia.

Way Forward

- A broader health strategy is required to effectively address the issue of anaemia. Also, there is a need to bridge the gap between policy and practice.

- The mother’s health needs to be addressed as anaemia in mothers and premature delivery can also lead to childhood anaemia.

- In addition to the maternal influence on childhood anaemia, paternal and overall household influences need to be considered for a more comprehensive policy framework for intervention at the household level.

YuWaah Youth Skilling Initiative

Why in News

The United Nations Children's Fund (UNICEF) launched the ‘YuWaah’ Generation Unlimited in India on November 1, 2019.

Key Points

- Generation Unlimited (GenU), called YuWaah in India, is a global multisector and multi-stakeholder alliance created to meet the need of expanded education, skill development and employment opportunities for young people aged 10-24.

- It brings together partners from government, multilateral organizations, civil society, the private sector and young people from around the world.

- The target age group of YuWaah includes adolescent girls and boys and its key mission is to promote access to foundational, transferable and 21st-century skills for youth inside and outside formal education systems.

- YuWaah intends to create platforms to guide youth to market opportunities (career guidance, mentorship, internships, apprenticeships) and facilitate the integration of career guidance in school education.

- GenU aims to:

- Modernize secondary education and training to build the skills young people need for productive lives and work.

- Increase and improve the number of quality work opportunities available to youth.

- Foster entrepreneurship as a mindset and a livelihood for young people.

- Collaborate with youth as problem-solvers and engage citizens to help create the world they want.

- GenU is also an effective way to operationalize the vision and priorities of the UN Youth Strategy—in particular, youth engagement, participation and advocacy; supporting young people’s greater access to quality education and skills development; and economic empowerment through decent jobs.

Typhoon Kammuri

Why in News

Recently, a typhoon struck the Philippines, bringing heavy rains and suspending air travel. The government issued the warnings of floods, storm surges and landslides.

Key Points

- It is known locally as Tisoy and is the 20th typhoon to hit the country this year.

- Tropical Cyclone

- Cyclone is the formation of a very low-pressure system with very high-speed winds revolving around it. Factors like wind speed, wind direction, temperature and humidity contribute to the development of cyclones.

- Cyclones are called 'Hurricanes' in the North Atlantic and Eastern Pacific, 'Typhoons' in South-East Asia and China and ‘Tropical Cyclones’ in the South-West Pacific and Indian Ocean Region.