Russian Banks Excluded from SWIFT | 28 Feb 2022

For Prelims: Society for Worldwide Interbank Financial Telecommunication (SWIFT), System for Transfer of Financial Messages, Cryptocurrencies.

For Mains: Bilateral Groupings & Agreements , Russia’s war over Ukraine,Impact of sanctions on Russia, SWIFT and its Significance.

Why in the News?

Recently, in a move to counter Russia’s war over Ukraine, the US and the European Commission issued a joint statement to exclude some Russian banks from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) messaging system.

- The intention behind this action is to further isolate Russia from the international financial system.

- The move against Russia is only partly implemented for now, with only some Russian banks being covered.

- The option of expanding it further to a pan-country ban is something that the US and its allies are holding back as a further escalatory move.

What is the SWIFT Messaging System?

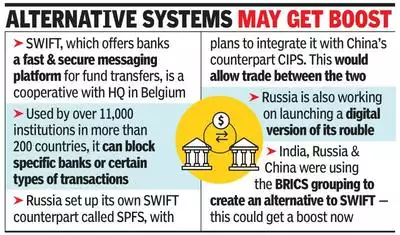

- SWIFT provides the trusted messaging platform that enables financial institutions to exchange information about global monetary transactions such as money transfers.

- While SWIFT does not actually move money, it operates as a middleman to verify information of transactions by providing secure financial messaging services to more than 11,000 banks in over 200 countries.

- Most of the world trade takes place with financial messaging passing through SWIFT.

- It was established in 1973 and is based in Belgium.

- It is overseen by the central banks from eleven industrial countries: Canada, France, Germany, Italy, Japan, the Netherlands, Sweden, Switzerland, the United Kingdom, and the United States, besides Belgium.

- India’s financial system has access to the SWIFT.

- Prior to SWIFT, the only reliable means of message confirmation for international funds transfer was Telex.

- It was discontinued due to a range of issues such as low speed, security concerns, and a free message format.

What will be Impact on Russia?

- Russia is heavily reliant on the SWIFT platform for its key natural resources trade, especially the payments for its oil and gas exports.

- It will freeze the assets of Russia’s central bank, which would stop Russia from “using its war chest”, referring to its forex reserves.

- Further, the curbs on Russia’s central bank will prevent it from dipping into its forex deposits to limit the effect of sanctions.

- Targeting only some Russian banks seems to be aimed at both keeping the option of further escalation open.

- it also envisages that the sanctions have the maximum possible impact on Russia, but prevent a major impact on European companies dealing with Russian banks for payments for their gas imports

- There is going to be a catastrophe on the Russian currency market.

- Prior to this, only one country had been cut off from SWIFT — Iran. It resulted in it losing a third of its foreign trade.

How did Russia React?

- Russia has worked on alternatives, including the SPFS (System for Transfer of Financial Messages) — an equivalent of the SWIFT financial transfer system developed by the Central Bank of Russia.

- Russia is reported to be collaborating with the Chinese on a possible venture which will be a potential challenger to SWIFT.

- There are plans to integrate it with China's Cross-border Inter-bank Payments System (CIPS).

What are Other Global Alternatives to SWIFT?

- There are financial technology companies like Ripple, which has been offering its platform based on interledger protocol (the same technology behind cryptocurrencies) as an alternative.

- Cryptocurrencies are another avenue for cross border remittances. Russia has also been working on a 'digital' rouble, which is still not launched.

How will the Sanctions Impact India?

- Following the collapse of the Soviet Union in 1991, India had entered into a rupee-rouble trade arrangement with Russia to ensure that defence and other imports could continue.

- In 2018, a pilot project was run where Indian importers paid in roubles for diamond imports.

- These payments were made to the Indian branch of Russia's Sberbank. SBI and Canara Bank have a joint venture (The Commercial Indo Bank), which might be able to help Indians there.