Recession and Yield Curve | 27 Dec 2022

For Prelims: Recession, Yield Curve

For Mains: Growth & Development

Why in News?

In many of the world's top economies, including the United States, the biggest and most consequential, there are fears of recession as the new year approaches.

- The US does look headed for a recession — a key pointer is the inversion of US treasury yields.

What is a Recession?

- A recession typically involves the overall output in an economy contracting for at least two consecutive quarters, along with job losses and reduction in overall demand.

- The US National Bureau of Economic Research (NBER) decides whether the economy is in a recession based on its assessment of the depth, diffusion, and duration of the impact on the economy.

- Sometimes, the duration may not be long but the decline could be very severe — as it happened in the wake of the Covid-19 pandemic.

- Or, the depth and diffusion may be relatively less but the downturn may last long — as is expected in the United Kingdom in the wake of the economic crisis.

What are US Treasuries?

- In any economy, the safest loans are those that are given to governments — entities that will always be there, and which typically do not default on their debt.

- Governments need to borrow money because their tax revenues more often than not aren’t enough to finance all their spending.

- The instrument by which the government borrows from the market is called a government bond.

- In India they are called G-secs, in the UK they are called gilts, and in the US, they are called treasuries.

What is the Yield of a Treasury?

- Unlike a bank loan, on which the interest rate varies with time, a government bond comes with pre-determined “coupon” payment.

- So, the US government may “float” a 10-year bond with a face value of USD100 and coupon payment of USD 5. This means, if you lend USD100 to the US government by buying this bond, you would get USD 5 each year for the next 10 years plus the whole sum of USD100 at the end of 10 years. This would imply a yield of 5%.

- But if for some reason one sold this bond to another investor, the yield will change depending on the price at which the bond is sold. If the price increases — say, the bond is sold for USD110 — the yield will fall because the annual return (USD5) remains the same. And if the price falls, the yield will rise.

What is the Yield Curve?

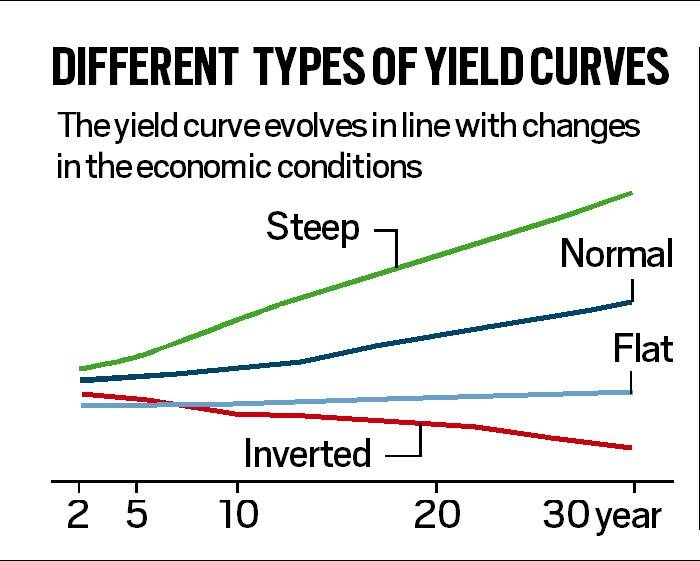

- Governments borrow for durations ranging from 1 month to 30 years.

- Typically, yields are higher for longer tenures because one is lending money for longer.

- If the yields for different tenures of bonds are mapped, it will give an upward-sloping curve.

- The curves can be flat or steep depending on the money available in the market and the expected overall economic activity. When investors feel buoyant about the economy, they pull money out of long-term bonds and put it into short-term riskier assets such as stock markets. As prices of long-term bonds fall, their yields rise — and the yield curve steepens.

What is Yield Inversion?

- Yield inversion happens when yields for shorter duration bonds are higher than the yields on longer duration bonds. If investors suspect that the economy is heading for trouble, they will pull out money from short-term risky assets (such as stock markets) and put it in long-term bonds. This causes the prices of the long-term bonds to rise and their yields to fall. This process first leads to flattening and eventually the inversion of the yield curve.

- Yield inversion has long been a reliable predictor of recession in the US — and US treasuries have been witnessing yield inversion for a while now.

- The spread between the yields of 10-year and 3-month treasuries has turned negative.

Why does this matter to India?

- Rising interest rates are likely to make the US dollar even more strong against the rupee. Indian imports will become costlier as a result, and could fuel domestic inflation.

- Higher returns in the US may also lead to some rebalancing of the investments coming to India.

- Indian exports may benefit due to a weaker rupee but a recession will dampen the demand for Indian exports.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. Which among the following steps is most likely to be taken at the time of an economic recession?

(a) Cut in tax rates accompanied by increase in interest rate.

(b) Increase in expenditure on public projects.

(c) Increase in tax rates accompanied by reduction of interest rate.

(d) Reduction of expenditure on public projects.

Ans: (b)

Exp:

- Economic recession is a macroeconomic term that refers to a slowdown or a massive contraction in economic activities for a long enough period, or it can be said that when a recessionary phase sustains for long enough, it is called a recession.

- In order to tackle the economic recession, the money supply in the economy must be increased. There are various ways to boost money supply into the economy:

- Expansionary Monetary Policy: It will increase the supply of money in the market. Banks and Financial Institutions will have more money to lend with leveraged interest rates. This will attract the borrowers to borrow money, thereby increasing the economic activities and expenditure such as investment, production, consumption etc.

- High Expenditure on Public Projects: Increase in expenditure on public projects will lead to increase in money supply and will be helpful in bringing the country out of economic recession.

- Cutting the tax rate will increase the money supply in the economy, however high interest rate will lead to low money supply as banks will be giving loans on higher interest rates and it will lead to low borrowings.

- Reduction in the interest rate will increase the money supply in the economy and will help in tackling the economic recession, however increase in tax rates will not be helpful in that direction since it will lead to less expenditure by the people.

- Reduction of expenditure on public projects will decrease the money supply in the economy. Therefore, option (b) is the correct answer.