Pradhan Mantri Fasal Bima Yojana (PMFBY) | 16 Jul 2022

For Prelims: Pradhan Mantri Fasal Bima Yojana (PMFBY), Zero Premium, Subsidies, Crop Insurance

For Mains: Pradhan Mantri Fasal Bima Yojana, Government Policies & Interventions

Why in News?

Recently, after opting out in 2019-20, the Andhra Pradesh government has returned to the crop insurance scheme Pradhan Mantri Fasal Bima Yojana (PMFBY).

What is Pradhan Mantri Fasal Bima Yojana?

- About:

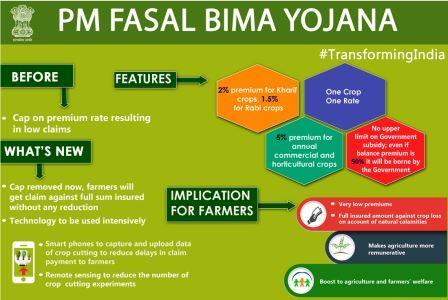

- Launched in 2016 and is being administered by the Ministry of Agriculture and Farmers Welfare.

- It replaced the National Agricultural Insurance Scheme (NAIS) and Modified National Agricultural Insurance Scheme (MNAIS).

- Eligibility:

- Farmers including sharecroppers and tenant farmers growing notified crops in the notified areas are eligible for coverage.

- Objectives:

- To provide insurance coverage and financial support to the farmers in the event of failure of any of the notified crops as a result of natural calamities, pests & diseases.

- To stabilize the income of farmers to ensure their continuance in farming.

- To encourage farmers to adopt innovative and modern agricultural practices.

- To ensure the flow of credit to the agriculture sector.

- Premium:

- There will be a uniform premium of only 2% to be paid by farmers for all Kharif crops and 1.5% for all Rabi crops.

- In the case of annual commercial and horticultural crops, the premium to be paid by farmers will be only 5%.

- The premium rates to be paid by farmers are very low and the balance premium will be paid by the Government to provide full insured amount to the farmers against crop loss on account of natural calamities.

- There is no upper limit on Government subsidies. Even if the balance premium is 90%, it will be borne by the Government.

- Earlier, there was a provision of capping the premium rate which resulted in low claims being paid to farmers.

- This capping was done to limit Government's outgo on the premium subsidy.

- This capping has now been removed and farmers will get a claim against the full sum insured without any reduction.

- Use of Technology:

- Crop Insurance App:

- Provides for easy enrollment of farmers.

- Facilitate easier reporting of crop loss within 72 hours of occurrence of any event.

- Latest Technological Tools: To assess crop losses, satellite imagery, remote-sensing technology, drones, artificial intelligence and machine learning are used.

- PMFBY Portal: For integration of land records.

- Crop Insurance App:

- Recent Changes:

- The scheme was once mandatory for loanee farmers, but 2020, the Centre changed it to make it optional for all farmers.

- Earlier the rate of average premium subsidy including the difference between the actuarial premium rate and the rate of the insurance premium payable by the farmer was shared by the state and center, further states and UTs were free to extend additional subsidies over and above the average subsidy from their budgets.

- The Centre decided in February 2020 to limit its premium subsidy to 30% for unirrigated areas and 25% for irrigated ones (from the existing unlimited). Previously, the central subsidy had no upper limit.

- The scheme was once mandatory for loanee farmers, but 2020, the Centre changed it to make it optional for all farmers.

What were the Issues Related to the Scheme?

- Financial Constraints of States: The financial constraints of the state governments and low claim ratio during normal seasons are the major reasons for non-implementation of the Scheme by these States.

- States are unable to deal with a situation where insurance companies compensate farmers less than the premium they have collected from them and the Centre.

- The State governments failed to release funds on time leading to delays in releasing insurance compensation.

- This defeats the very purpose of the scheme which is to provide timely financial assistance to the farming community.

- Claim Settlement Issues: Many farmers are dissatisfied with both the level of compensation and delays in settlement.

- The role and power of Insurance companies is significant. In many cases, it didn't investigate losses due to a localised calamity and, therefore, did not pay the claims.

- Implementation Issues: Insurance companies have shown no interest in bidding for clusters that are prone to crop loss.

- Further, it is in the nature of the insurance business for entities to make money when crop failures are low and vice-versa.

Way Forward

- There is a need for comprehensive rethinking among states and the central governments to further resolve all the pending issues around the scheme so that the farmers could get benefit from this scheme.

- Further, rather than paying subsidies under this scheme, the state government should invest that money in a new insurance model.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. With reference to ‘Pradhan Mantri Fasal Bima Yojana’, consider the following statements: (2016)

- Under this scheme, farmers will have to pay a uniform premium of two percent for any crop they cultivate in any season of the year.

- This scheme covers post-harvest losses arising out of cyclones and unseasonal rains.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ANS: (b)

Exp:

- Pradhan Mantri Fasal Bima Yojana is a crop insurance scheme launched by the Union Government. It covers pre-harvest and post-harvest losses arising out of natural calamities (cyclones and unseasonal rains), pests, and diseases. Hence, statement 2 is correct.

- Key Features

- Uniform premium of only 2% to be paid by farmers for all Kharif crops and 1.5% for all Rabi crops. Hence, statement 1 is not correct.

- A premium of 5% is to be paid for annual commercial and horticultural crops.

- The premium rates to be paid by farmers are very low and the balance premium will be paid by the Government.

- There is no upper limit on Government subsidies. Even if the balance premium is 90%, it will be borne by the Government.

- Capping on the premium has now been removed and farmers will get a claim against the full sum insured without any reduction.

- The use of technology is encouraged to a great extent. Smartphones will be used to capture and upload data of crop cutting to reduce the delays in claim payments to farmers. Remote sensing will be used to reduce the number of crop-cutting experiments. Therefore, option (b) is the correct answer.