Parliamentary Committee Report on Startups | 16 Sep 2020

Why in News

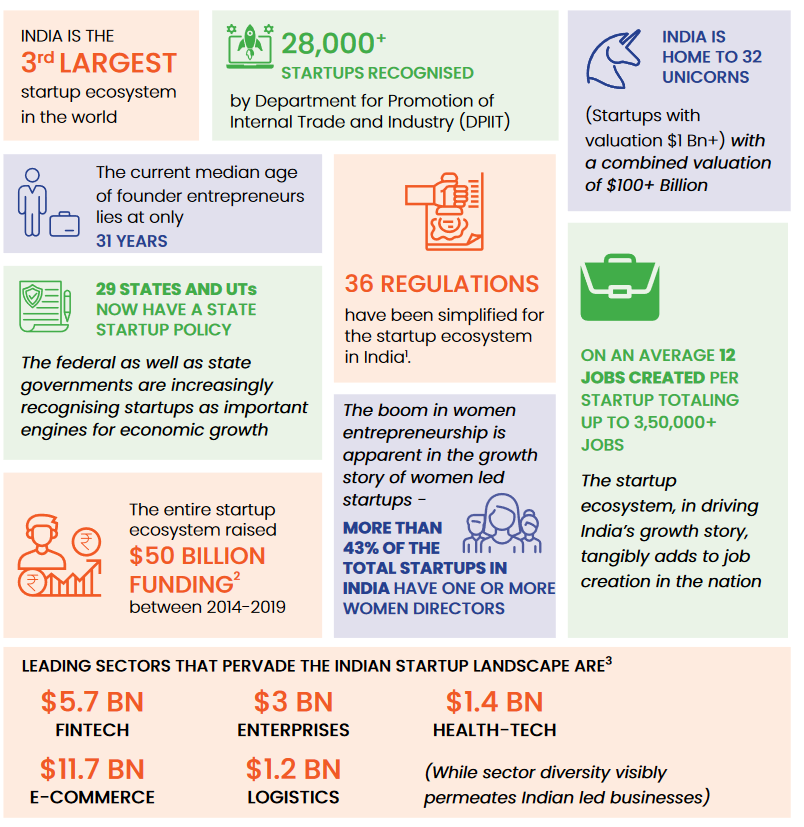

Recently, the Parliamentary Standing Committee on Finance tabled a report related to startups in Parliament. The Government of India has initiated a Startup India Scheme in 2016.

Key Points

- Recommendations:

- Indian start-ups need to reduce their dependence on China and the USA, so that India becomes self-reliant by having several large domestic growth funds powered by domestic capital.

- E.g Small Industries Development Bank of India (SIDBI) Fund-of-Funds vehicle should be expanded and fully operationalised to play an investment role.

- A fund-of-funds also known as a multi-manager investment—is a pooled investment fund that invests in other types of funds.

- Foreign development finance institutions may also be encouraged to participate with local asset management companies to set up fund-of-funds structures.

- E.g Small Industries Development Bank of India (SIDBI) Fund-of-Funds vehicle should be expanded and fully operationalised to play an investment role.

- The companies and Limited Liability Partnerships (LLPs) should be allowed to invest in start-ups without being classified as Non-banking Financial Companies (NBFCs) by the Reserve Bank of India (RBI) to expand capital sources for start-ups.

- Abolition of Long Term Capital Gains (LTCG) tax on Collective Investment Vehicles (CIVs) for at least the next two years to encourage investment in start-ups and to drive a sharp post-pandemic revival.

- At present, LTCG earned by foreign investors in private companies attracts taxation at a rate of 10%, in comparison to the domestic venture capital investments which are taxed at 20% (for LTCG) with an enhanced surcharge of 37%.

- After a two-year period, the Securities Transaction Tax (STT) may be applied to CIVs so that revenue neutrality is maintained.

- A CIV is any entity that allows investors to pool their money and invest the pooled funds, rather than buying securities directly as individuals. It is usually managed by a fund management company which is paid a fee for doing so.

- Examples of CIV: angel funds, alternate investment funds and investment LLP.

- Indian start-ups need to reduce their dependence on China and the USA, so that India becomes self-reliant by having several large domestic growth funds powered by domestic capital.

- Benefits: A strong start-up ecosystem can propel investment, jobs, and demand creation in the economy.

Startup India Scheme

- It is a flagship initiative of the Government of India, intended to catalyse startup culture and build a strong and inclusive ecosystem for innovation and entrepreneurship in India.

- Since the launch of the initiative in 2016, Startup India has rolled out several programs with the objective of supporting entrepreneurs, and transforming India into a country of job creators instead of job seekers.

- A startup is an enterprise that is initiated by its founders around an idea or a problem with a potential for significant business opportunity and impact.

Securities Transaction Tax

- It is a tax levied at the time of purchase and sale of securities listed on stock exchanges in India.

- Both purchaser and seller both need to pay 0.1% of share value as STT.

Capital Gain Tax

- Any profit or gain that arises from the sale of a ‘capital asset’ is a capital gain. This gain or profit comes under the category of ‘income’.

- Land, building, house property, vehicles, patents, trademarks, leasehold rights, machinery, and jewellery are a few examples of capital assets.

- Hence, the capital gain tax will be required to be paid for that amount in the year in which the transfer of the capital asset takes place. This is called the capital gains tax, which can be both short-term or long-term.

- Long-term Capital Gains Tax: It is a levy on the profits from the sale of assets held for more than a year.

- Short-term Capital Gains Tax: It applies to assets held for a year or less and is taxed as ordinary income.

Small Industries Development Bank of India

- Small Industries Development Bank of India (SIDBI) was set up in 1990. It is a statutory body established under an Act of Parliament.

- It acts as the principal financial institution for promotion, financing and development of the Micro, Small and Medium Enterprise (MSME) sector as well as for coordination of functions of institutions engaged in similar activities.