Monetary Policy Report: RBI | 10 Dec 2021

Why in News

The Reserve Bank of India (RBI) has released the Monetary Policy Report (MPR) for the month of December 2021.

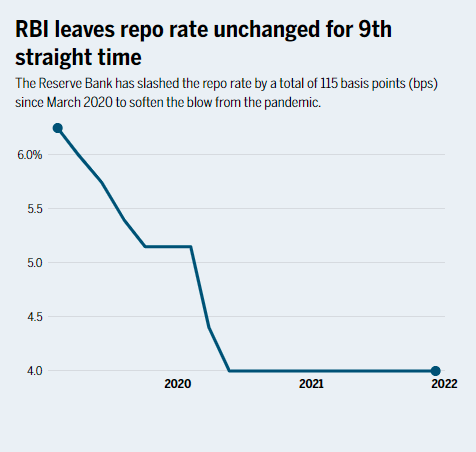

- It kept the policy rate unchanged for the Ninth time in a row maintaining an accommodative stance.

Key Points

- Unchanged Policy Rates:

- Repo Rate - 4%.

- Reverse Repo Rate - 3.35%.

- Marginal Standing Facility (MSF) - 4.25%.

- Bank Rate- 4.25%.

- GDP Projection:

- Real Gross Domestic Product (GDP) growth for 2021-22 has been retained at 9.5%.

- Inflation:

- RBI has retained the projection for Consumer Price Index (CPI) inflation at 5.3 %.

- Variable Reverse Rate Repo (VRRR):

- It increased the amount of money it will absorb VRRR to Rs 7.5 lakh crore by the end of December 2021.

- In order to absorb additional liquidity in the system, the RBI announced conducting a VRRR program in August 2021 because it has higher yield prospects as compared to the fixed rate overnight reverse repo.

- It increased the amount of money it will absorb VRRR to Rs 7.5 lakh crore by the end of December 2021.

- Accommodative Stance:

- RBI decided to continue with an accommodative stance until there is sustainable recovery in the economy.

- An accommodative stance means the MPC is willing to either lower rates or keep them unchanged.

- Significance:

- It encourages more spending from consumers and businesses by making money less expensive to borrow through the lowering of short-term interest rates.

- When money is easily accessible through banks, the money supply in the economy increases. This leads to increased spending.

- It allows the fiscal reserve to increase in relation to national income and the positive function of money demand.

- It helps energize the national money stock and prevent a weak aggregate demand obviating an economic recession.

- Therefore it can be said that an accommodative stance will help improve India’s growth.

- RBI decided to continue with an accommodative stance until there is sustainable recovery in the economy.

- No Permission for Infusing Capital:

- The RBI allowed banks to infuse capital in their overseas branches as well as repatriate profits without seeking its prior approval, subject to fulfilling certain regulatory capital requirements.

- At present, banks incorporated in India can infuse capital in their overseas branches and subsidiaries, retain profits in these centres and repatriate/ transfer the profits with prior approval of the RBI.

- With a view to providing operational flexibility to banks, it has been decided that banks need not seek prior approval of the RBI if they meet the regulatory capital requirements.

- The RBI allowed banks to infuse capital in their overseas branches as well as repatriate profits without seeking its prior approval, subject to fulfilling certain regulatory capital requirements.

Monetary Policy Report

- It is published by the Monetary Policy Committee (MPC) of RBI. It is a statutory and institutionalized framework under the RBI Act, 1934, for maintaining price stability, while keeping in mind the objective of growth.

- It determines the policy interest rate (repo rate) required to achieve the inflation target of 4% with a leeway of 2% points on either side. The Governor of RBI is ex-officio Chairman of the MPC.

Key Terms

- Repo and Reverse Repo Rate:

- Repo rate is the rate at which the central bank of a country (RBI in case of India) lends money to commercial banks in the event of any shortfall of funds. Here, the central bank purchases the security.

- Reverse repo rate is the rate at which the RBI borrows money from commercial banks within the country.

- Bank Rate:

- It is the rate charged by the RBI for lending funds to commercial banks.

- Marginal Standing Facility (MSF):

- MSF is a window for scheduled banks to borrow overnight from the RBI in an emergency situation when interbank liquidity dries up completely.

- Open Market Operations:

- These are market operations conducted by RBI by way of sale/purchase of government securities to/from the market with an objective to adjust the rupee liquidity conditions in the market on a durable basis.

- Government Security:

- A G-Sec is a tradable instrument issued by the Central Government or the State Governments. It acknowledges the government’s debt obligation.

- Consumer Price Index:

- It measures price changes from the perspective of a retail buyer. It is released by the National Statistical Office (NSO).

- The CPI calculates the difference in the price of commodities and services such as food, medical care, education, electronics etc, which Indian consumers buy for use.