Monetary Policy Report: RBI | 09 Oct 2021

Why in News

The Reserve Bank of India (RBI) has released the Monetary Policy Report (MPR) for the month of October 2021.

- It kept the policy rate unchanged for the Eighth time in a row maintaining an accommodative stance till the recovery is durable.

Key Points

- Unchanged Policy Rates:

- Repo Rate - 4%.

- Reverse Repo Rate - 3.35%.

- Marginal Standing Facility (MSF) - 4.25%.

- Bank Rate- 4.25%.

- GDP Projection:

- Real Gross Domestic Product (GDP) growth for 2021-22 has been retained at 9.5%.

- Inflation:

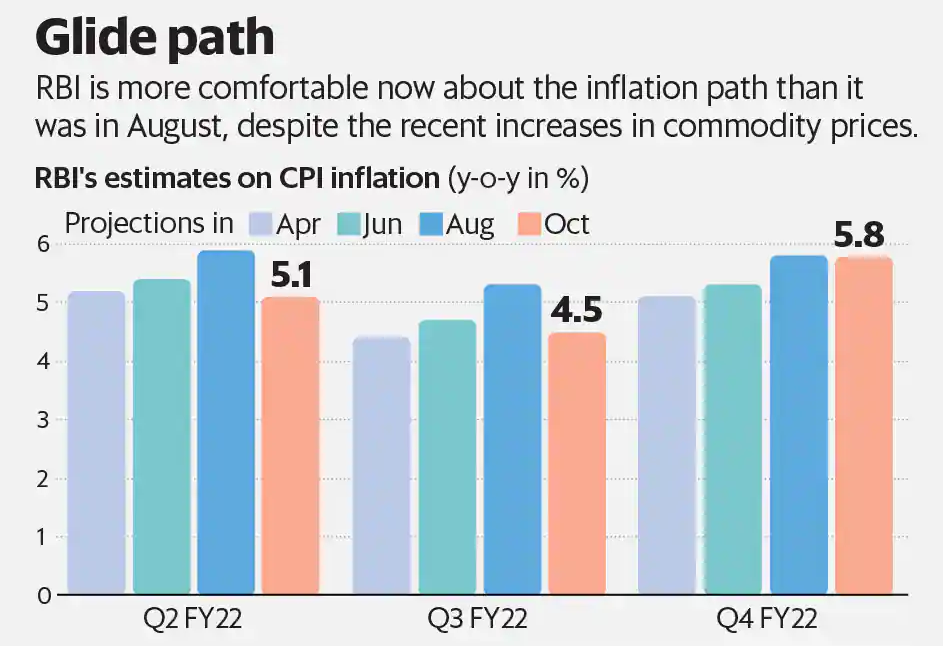

- RBI has revised the projection for Consumer Price Index (CPI) inflation to 5.3% from 5.7% in August 2021.

- Government Bond Acquisition Programme (GSAP):

- It has shut down the GSAP citing the liquidity overhang (Excess liquidity), increasing liquidity due to government spending and absence of higher borrowing for Goods and Services Tax compensation.

- It is part of RBIs Open Market Operations, where it commits to a specific amount of Open Market Purchases of government securities.

- The first purchase for an aggregate amount of Rs. 25,000 crore under G-SAP 1.0 was conducted in April, 2021.

- But has assured that it would continue to flexibly conduct other liquidity management operations, including Operation Twist (OT) and regular Open Market Operations (OMOs).

- OT is when the central bank uses the proceeds from the sale of short-term securities to buy long-term government debt papers, leading to easing of interest rates on the long term papers.

- It has shut down the GSAP citing the liquidity overhang (Excess liquidity), increasing liquidity due to government spending and absence of higher borrowing for Goods and Services Tax compensation.

- Accommodative Stance:

- It decided to continue with an accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of Covid-19 on the economy, while ensuring that inflation remains within the target going forward.

- An accommodative stance means a central bank will cut rates to inject money into the financial system whenever needed.

- It decided to continue with an accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of Covid-19 on the economy, while ensuring that inflation remains within the target going forward.

- Variable Reverse Rate Repo (VRRR):

- VRRR auction size has been enhanced to Rs 6 trillion by early December 2021 and opened itself up to increasing the VRRR duration to 28 days if need be.

- In order to absorb additional liquidity in the system, the RBI announced conducting a VRRR program in August 2021 because it has higher yield prospects as compared to the fixed rate overnight reverse repo.

- VRRR auction size has been enhanced to Rs 6 trillion by early December 2021 and opened itself up to increasing the VRRR duration to 28 days if need be.

Key Terms

- Repo and Reverse Repo Rate:

- Repo rate is the rate at which the central bank of a country (RBI in case of India) lends money to commercial banks in the event of any shortfall of funds. Here, the central bank purchases the security.

- Reverse repo rate is the rate at which the RBI borrows money from commercial banks within the country.

- Bank Rate:

- It is the rate charged by the RBI for lending funds to commercial banks.

- Marginal Standing Facility (MSF):

- MSF is a window for scheduled banks to borrow overnight from the RBI in an emergency situation when interbank liquidity dries up completely.

- Open Market Operations:

- These are market operations conducted by RBI by way of sale/purchase of government securities to/from the market with an objective to adjust the rupee liquidity conditions in the market on a durable basis.

- Government Security:

- A G-Sec is a tradable instrument issued by the Central Government or the State Governments. It acknowledges the government’s debt obligation.

- Consumer Price Index:

- It measures price changes from the perspective of a retail buyer. It is released by the National Statistical Office (NSO).

- The CPI calculates the difference in the price of commodities and services such as food, medical care, education, electronics etc, which Indian consumers buy for use.

Monetary Policy Report

- It is published by the Monetary Policy Committee (MPC) of RBI. It is a statutory and institutionalized framework under the RBI Act, 1934, for maintaining price stability, while keeping in mind the objective of growth.

- It determines the policy interest rate (repo rate) required to achieve the inflation target of 4% with a leeway of 2% points on either side. The Governor of RBI is ex-officio Chairman of the MPC.