Measures to Boost Consumption Demand and Capex | 13 Oct 2020

Why in News

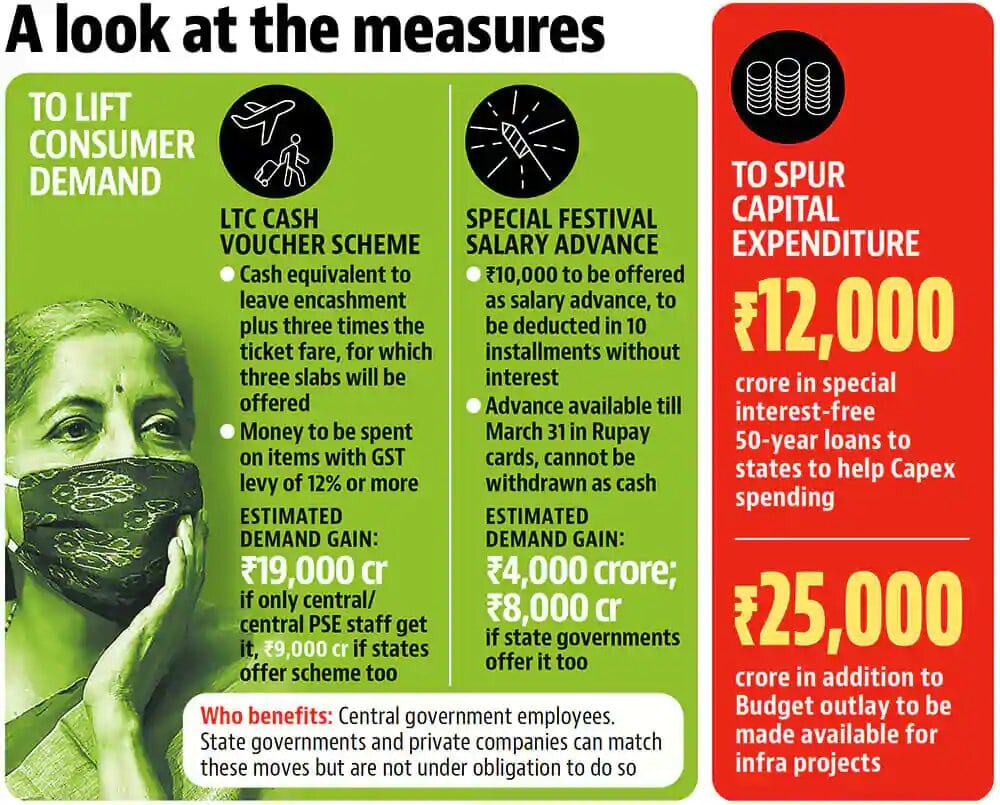

Recently, the government has announced a twin set of measures to boost consumption demand and capital expenditure (Capex), which are estimated to result in quick spending of more than Rs. 1 lakh crore by March 2021.

- These measures are the Leave Travel Concession (LTC) voucher scheme and a festival advance scheme. Also, measures have been announced to step up Capex by the Centre and the states.

Key Points

- Aim:

- Supply constraints in the economy have eased over recent months, but consumer demand remained affected and these measures aim at advancing consumer spending and Capex.

- Capex steps are “directly linked to an increase in economic output given their high multiplier effect”.

- The earlier announced Atmanirbhar Bharat package addressed the requirement of essential goods for needy sections of the society and now these measures aim at promoting consumption of high-value items by those employees whose salaries and jobs have not been affected by Covid-19 pandemic.

- With the participation of the private sector, these will stimulate growth in the economy by advancing the consumption of non-essential, relatively high-value goods and services in the economy.

- Supply constraints in the economy have eased over recent months, but consumer demand remained affected and these measures aim at advancing consumer spending and Capex.

- Leave Travel Concession Voucher Scheme:

- Leave Travel Concession:

- Central government employees get LTC in a block of four years, one each to a destination of choice and home town or two for home town.

- Under this, the air or rail fare is reimbursed as per pay scale/entitlement. Also, a leave encashment of ten days (pay+dearness allowance) is paid.

- However, employees will not be able to avail the LTC in the 2018-21 year block due to the ongoing pandemic and this is where the LTC will benefit government employees.

- In lieu of one LTC during 2018-21, employees will receive cash payment. There will be full payment on leave encashment and fare will be paid as per three slabs depending upon the class of entitlement. Further, there will be no tax on fare payment.

- An employee opting for this scheme will have to buy goods and services worth three times the fare and one time leave encashment, and do so before 31st March 2021.

- The money is to be spent on goods attracting Goods and Services Tax (GST) of 12% or more and only digital payments will be allowed. Also, employees will have to provide the GST invoice.

- If the amount is not spent then the employee will have to pay tax as per the marginal tax rate on the LTC component.

- The same benefits will be available to private-sector employees if the employers decide to offer the scheme to their employees and they decide to avail it.

- Benefits to Economy:

- The government expects a demand generation of Rs. 28,000 crore (Rs. 19,000 crore from central government employees and the rest from states) in the economy.

- While GST collections have been severely impacted in the first half of the fiscal due to Covid-19 pandemic, a consumption boost will lift GST collections in the second half of the year as the scheme calls for expenditure to be done till 31st March 2021.

- If private-sector employees also participate, it may lead to a significant jump in overall consumption and rise in GST collections.

- Since most employees have not been able to travel after the pandemic, the shifting of the LTC benefit is expected to generate demand elsewhere.

- Leave Travel Concession:

- Festival Advance:

- Festival advance, which was abolished in line with recommendations of the 7th Pay Commission, has been restored for one time till 31st March 2021.

- All central government employees will get an interest-free advance of Rs. 10,000 that will be recovered in 10 instalments. It will be given in the form of a pre-loaded RuPay card of the advance value.

- The government expects to disburse Rs. 4,000 crore under the scheme by 31st March 2021 and if all states provide similar advances, another Rs. 8,000 crore is likely to be disbursed.

- This is expected to generate consumer demand ahead of festivals like Diwali.

- Other Measures to Boost Capital Expenditure:

- An additional budget of Rs 25,000 crore for Capex on roads, defence infrastructure, water supply, urban development, and domestically produced capital equipment. This is expected to come through re-allocation of resources.

- Special assistance will be provided to states in the form of interest-free 50-year loans of Rs. 12,000 crore, which can be used only for Capex purposes, with certain conditions.

- Concerns:

- Too Many Restrictions: Provisions like buying goods and services worth three times the fare, only in goods attracting GST of 12% or more through digital mode before 31st March etc. end the freedom of the consumer in decision making.

- Smaller Size: Capex amounts are too small to have any meaningful impact on economic growth.

- With the previous rounds of budgetary fiscal support of around 1% of GDP, current measures take total fiscal support to about 1.2% of GDP, which is small compared with the size of the growth hit and reflects India’s weak fiscal starting position.

- Limited Impact: As the measures are aimed at encouraging spending for government employees rather than private/vulnerable section (where job losses/income losses have been significant), the overall impact will be limited.

- On Tourism: LTC Voucher Scheme may impact the travel and tourism industry negatively if consumers choose to spend through the scheme. Demand in travel and tourism has already fallen significantly after the Covid-19 induced lockdowns and closed borders.

Way Forward

- The government seeks to coincide the schemes with the upcoming festive period to spur overall consumption and is also spending less to not to put additional burden on the exchequer, in the midst of a notable shortfall in tax and divestment revenues.

- The strategic intent behind the schemes is to direct spending towards items for which demand had slumped during the period of lockdowns but this may defeat the larger purpose of reviving demand. Consumption-led growth can arguably lead to a slackening of future growth if it entails growing imbalances due to limits to capacity creation, and rising debt burdens, particularly for households.