Liberalised Remittance Scheme | 18 Sep 2019

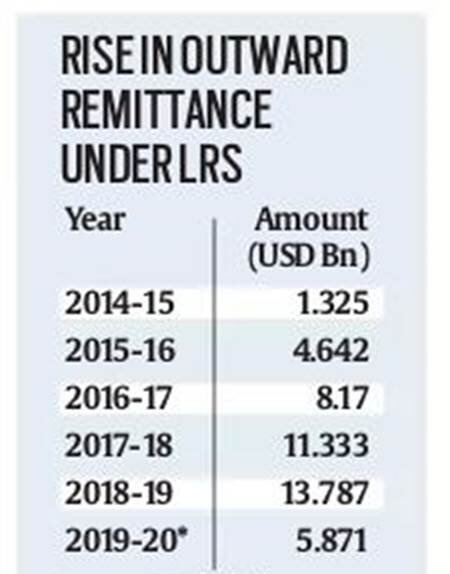

India has witnessed its highest-ever monthly outflow of $1.69 billion under the Liberalised Remittance Scheme (LRS) in July 2019.

- The outflow of funds by resident Indians under LRS over the last five years has almost negated the inflow of funds by Foreign Portfolio Investors (FPIs) in the same period.

- The sharp rise in the outflow of funds under LRS scheme over the last five years indicates the flight of capital from the country.

Liberalised Remittance Scheme

- This is the scheme of the Reserve Bank of India, introduced in the year 2004.

- Under the scheme, all resident individuals, including minors, are allowed to freely remit up to USD 2,50,000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both.

- Not Eligible: The Scheme is not available to corporations, partnership firms, Hindu Undivided Family (HUF), Trusts etc.

- Though there are no restrictions on the frequency of remittances under LRS, once a remittance is made for an amount up to USD 2,50,000 during the financial year, a resident individual would not be eligible to make any further remittances under this scheme.

- Remitted Money can be used for:

- Expenses related to travelling (private or for business), medical treatment, study, gifts and donations, maintenance of close relatives and so on.

- Investment in shares, debt instruments, and buy immovable properties in the overseas market.

- Individuals can also open, maintain and hold foreign currency accounts with banks outside India for carrying out transactions permitted under the scheme.

- Prohibited Transactions:

- Any purpose specifically prohibited under Schedule-I (like the purchase of lottery tickets, proscribed magazines, etc.) or any item restricted under Schedule II of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

- Trading in foreign exchange abroad.

- Capital account remittances, directly or indirectly, to countries identified by the Financial Action Task Force (FATF) as “non- cooperative countries and territories”, from time to time.

- Remittances directly or indirectly to those individuals and entities identified as posing a significant risk of committing acts of terrorism as advised separately by the Reserve Bank to the banks.

- Requirements: It is mandatory for the resident individual to provide his/her Permanent Account Number (PAN) for all transactions under LRS made through Authorized Persons.

Foreign Exchange Management Act, 1999

- The legal framework for the administration of foreign exchange transactions in India is provided by the Foreign Exchange Management Act, 1999.

- Under the FEMA, which came into force with effect from 1st June 2000, all transactions involving foreign exchange have been classified either as capital or current account transactions.

- Current Account Transactions: All transactions undertaken by a resident that do not alter his / her assets or liabilities, including contingent liabilities, outside India are current account transactions.

- Example: payment in connection with foreign trade, expenses in connection with foreign travel, education etc.

- Capital Account Transactions: It includes those transactions which are undertaken by a resident of India such that his/her assets or liabilities outside India are altered (either increased or decreased).

- Example: investment in foreign securities, acquisition of immovable property outside India etc.

- Resident Indians: A 'person resident in India' is defined in Section 2(v) of FEMA, 1999 as :

- Barring few exceptions, a person residing in India for more than 182 days during the course of the preceding financial year.

- Any person or body corporate registered or incorporated in India.

- An office, branch or agency in India owned or controlled by a person resident outside India.

- An office, branch or agency outside India owned or controlled by a person resident in India.