Doing Away With Retrospective Taxation | 07 Aug 2021

Why in News

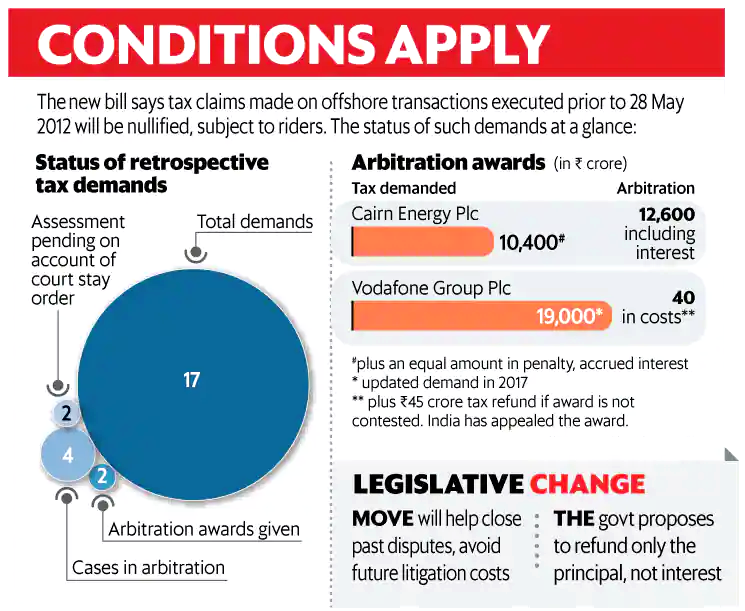

Recently, the Government of India has introduced The Taxation Laws (Amendment) Bill, 2021 in the Lok Sabha.

- The bill seeks to withdraw tax demands made using a 2012 retrospective legislation to tax the indirect transfer of Indian assets.

Key Points

- Background:

- The retrospective tax law was passed in 2012 following a Supreme Court verdict in favour of US-based Vodafone.

- The Dutch arm of Vodafone Group bought a Cayman Islands-based company in 2007, which indirectly held a majority stake in Indian firm Hutchison Essar Ltd—later renamed Vodafone India—for $11 billion.

- It was introduced after an amendment to the Finance Act enabled the tax department to impose retrospective capital gains tax for deals — involving the transfer of shares in foreign entities located in India — after 1962.

- While the amendment was aimed at penalising Vodafone, many other companies got caught in the crossfire and have created a host of problems for India over the years.

- It remains one of the most contentious amendments to the income tax law.

- Last year, India lost a case in international arbitral tribunal at The Hague against taxing Cairn Energy Plc and Cairn UK holdings Ltd on alleged capital gains the company made when in 2006 it reorganised its business in the country before listing the local unit.

- The retrospective tax law was passed in 2012 following a Supreme Court verdict in favour of US-based Vodafone.

- Proposed Changes in Bill:

- Amendments to the Income-tax Act and Finance Act, 2012 to effectively state that no tax demand shall be raised for any indirect transfer of Indian assets if the transaction was undertaken before 28th May 2012.

- Tax raised for the indirect transfer of Indian assets before May 2012 would be "nullified on fulfillment of specified conditions" such as the withdrawal of pending litigation and an undertaking that no damages claims would be filed.

- It also proposes to refund the amount paid by companies facing trail in these cases without interest thereon.

- Significance of the Bill:

- The bill marks a step in the direction of addressing the long-pending demand of foreign investors seeking the removal of retrospective tax for the sake of better tax clarity.

- This would help in establishing an investment-friendly business environment, which can increase economic activity and help raise more revenue over time for the government.

- This could help restore India’s reputation and improve ease of doing business.

Retrospective Taxation

- It allows a country to pass a rule on taxing certain products, items or services and deals and charge companies from a time behind the date on which the law is passed.

- Countries use this route to correct any anomalies in their taxation policies that have, in the past, allowed companies to take advantage of such loopholes.

- Retrospective Taxation hurts companies that had knowingly or unknowingly interpreted the tax rules differently.

- Apart from India, many countries including the USA, the UK, the Netherlands, Canada, Belgium, Australia and Italy have retrospectively taxed companies.

Capital Gain

- This gain or profit comes under the category of ‘income’.

- Hence, the capital gain tax will be required to be paid for that amount in the year in which the transfer of the capital asset takes place. This is called the capital gains tax, which can be both short-term or long-term.

- Long-term Capital Gains Tax: It is a levy on the profits from the sale of assets held for more than a year. The rates are 0%, 15%, or 20%, depending on the tax bracket.

- Short-term Capital Gains Tax: It applies to assets held for a year or less and is taxed as ordinary income.

- Capital gains can be reduced by deducting the capital losses that occur when a taxable asset is sold for less than the original purchase price. The total of capital gains minus any capital losses is known as the "net capital gains".

- Capital assets are significant pieces of property such as homes, cars, investment properties, stocks, bonds, and even collectibles or art.

Way Forward

- India needs to craft meaningful and clear dispute resolution mechanisms in cross-border transactions to prevent the disputes from going to international courts, and save the cost and time expenditure.

- Improving the arbitration ecosystem will have a positive impact on the ease of doing business.