Digital Payments Index: RBI | 02 Jan 2021

Why in News

The Reserve Bank of India (RBI) has constructed a composite Digital Payments Index (DPI) to capture the extent of digitisation of payments across the country.

Key Points

- About the Index:

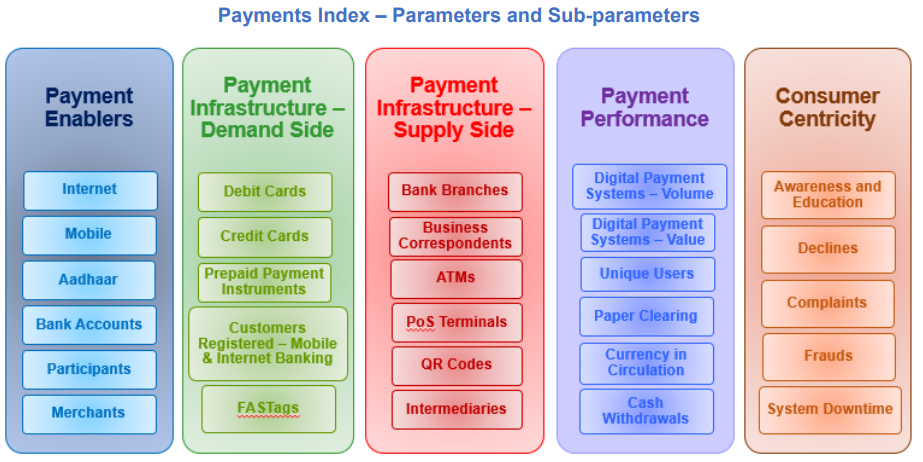

- The RBI-DPI comprises 5 broad parameters that enable measurement of deepening and penetration of digital payments in the country over different time periods.

- 5 Parameters:

- Payment Enablers (weight 25%),

- Payment Infrastructure – Demand-side factors (10%),

- Payment Infrastructure – Supply-side factors (15%),

- Payment Performance (45%) and

- Consumer Centricity (5%).

- It has been constructed with March 2018 as the base period, i.e. DPI score for March 2018 is set at 100.

- It will be published on RBI’s website on a semi-annual basis from March 2021 onwards with a lag of 4 months.

- Index Value for 2019 and 2020:

- The DPI for March 2019 and March 2020 worked out to be 153.47 and 207.84 respectively, indicating appreciable growth.

- Digital Payments Scenario:

- Data Analysis:

- During the second quarter (Q2) of 2020-21, Unified Payments Interface (UPI) payments recorded an 82% jump in volume and a 99% jump in value, compared with the same quarter last year, according to the Worldline India Digital Payments report.

- In Q2, 19 banks joined the UPI ecosystem, bringing the total number of banks providing UPI services to 174 as of September 2020 while the BHIM App was available for customers of 146 banks.

- In Q2, there were over 51.8 lakhs Point of Sale (PoS) terminals deployed by merchant acquiring banks, which is 13% higher than the same quarter of the previous year.

- A merchant acquiring bank is a bank that processes payments on behalf of a merchant.

- In 2018, the Bank for International Settlements (BIS) ranked India seventh among the 24 countries where it tracks digital payments.

- Recent Initiatives:

- The National Payments Corporation of India (NPCI) has recently given approval to WhatsApp to go live with UPI in a graded manner, starting with a maximum registered user base of 2 crores.

- The NPCI has also issued a cap of 30% of the total volume of transactions processed in UPI, which is applicable to all Third-Party App Providers (TPAPs) and is effective from 1st January 2021.

- The RBI has created a Payments Infrastructure Development Fund (PIDF) to encourage acquirers to deploy Points of Sale (PoS) infrastructure — both physical and digital modes — in tier-3 to tier-6 centres and north eastern states.

- Data Analysis:

RBI’s Other Publications

- Consumer Confidence Survey (CCS - Quarterly)

- Inflation Expectations Survey of Households (IESH - Quarterly)

- Financial Stability Report (Half-Yearly)

- Monetary Policy Report (Half-Yearly)

- Report on Foreign Exchange Reserves (Half-Yearly)