Stand Up India Scheme | 21 Jul 2021

Why in News

Recently, the Ministry of Finance has extended the Standup India Scheme up to the year 2025.

Key Points

- Launch:

- It was launched in April 2016 to promote entrepreneurship at the grass-root level focusing on economic empowerment and job creation.

- Aim:

- To leverage the institutional credit structure to reach out to the underserved sector of people such as SCs, STs and Women Entrepreneurs.

- Facilitates Bank Loans:

- The objective of this scheme is to facilitate bank loans between Rs.10 lakh and Rs.1 crore to at least one SC or ST borrower and at least one woman borrower per bank branch of Scheduled Commercial Banks for setting up a Greenfield enterprise.

- This enterprise may be in manufacturing, services or the trading sector.

- The objective of this scheme is to facilitate bank loans between Rs.10 lakh and Rs.1 crore to at least one SC or ST borrower and at least one woman borrower per bank branch of Scheduled Commercial Banks for setting up a Greenfield enterprise.

- Eligibility:

- SC/ST and/or women entrepreneurs; above 18 years of age.

- Loans under the scheme are available for only Greenfield projects.

- A greenfield project is one which is not constrained by prior work. It is constructed on unused land where there is no need to remodel or demolish an existing structure.

- Borrower should not be in default to any bank or financial institution.

- In case of non-individual enterprises, at least 51% of the shareholding and controlling stake should be held by either an SC/ST or Woman entrepreneur.

- New Changes:

- The margin money requirement for loans under the Scheme has been reduced from 'upto 25%' to 'upto 15%' and activities allied to agriculture have been included in the Scheme.

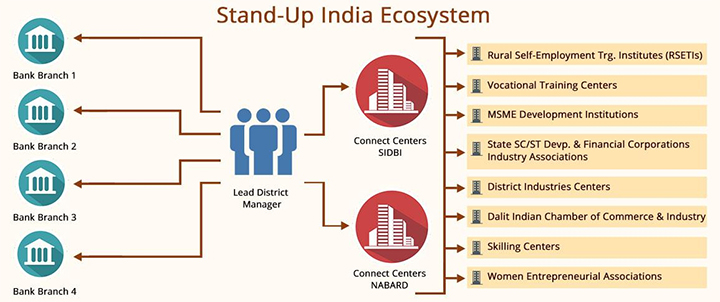

- Connect Centers:

- The offices of SIDBI (Small Industries Development Bank of India) and NABARD (National Bank for Agriculture and Rural Development) are designated Stand-Up Connect Centres (SUCC).

- Performance so far:

- Banks have sanctioned Rs 26,204 crore to about 1,16,266 beneficiaries under the Scheme in the last five years.

- The scheme has benefited more than 93,094 women entrepreneurs.