High-end Products In India

This article is based on How to boost export of high-end products which was published in the Hindu BusinessLine on 21/09/2021. It talks about the state of India’s export of high-end products and points out issues associated with their production.

Post-independence, the Indian economy was heavily dependent on the agricultural sector. It contributed more than 50% to the GDP. Over the years India gradually shifted from an agriculture based economy to the service based economy. Many economists believe that skipping the secondary sector is the main reason as to why the Indian economy has not developed as fast as other economies of the world.

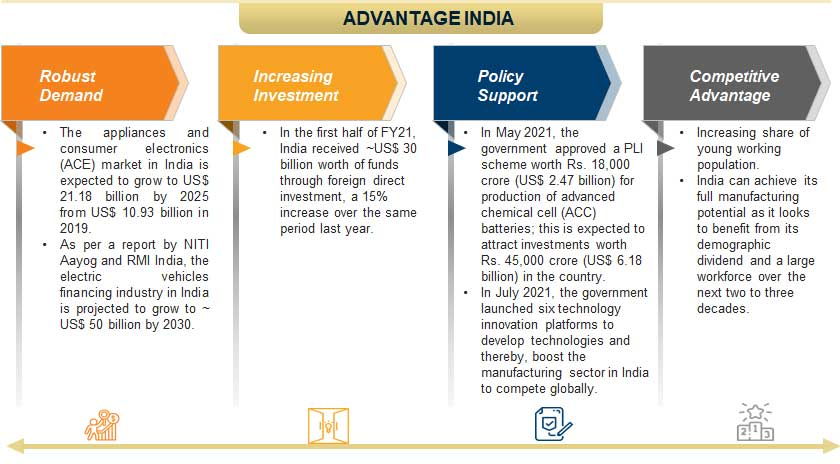

In recent years the manufacturing sector has been the major focus for the government of India. Realising the importance of the manufacturing sector and the amount of employment it can generate, many initiatives are being taken up by the current government to foster the growth of this sector.

However, it is imperative to shift manufacturing from low to high end products in order to achieve a higher economic growth rate.

State of High End Product Export

- Let us place products we export into two baskets- Basket A and Basket B.

- Basket A contains products traded in large values globally but in which India has a small share — examples, machinery, electronics and transport products account for 37% of global goods export basket.

- But the share of Indian exports in global exports of each of these is low.

- Machinery 0.9%, electronics 0.4% and transport goods 0.9%.

- More examples of our low share in important products. Integrated circuits (0.03%), computers (0.04%), solar-cells (0.3%), LED TV (0.02%), mobile phones (0.9%).

- Basket B Products: India has a large share in global exports, but the value of world trade in these products is small.

- For example, India's share in global textiles exports is 5.9%. But textile is a small category counting for just 1.3% of the global export basket.

- In marine products, India has a high share of 5.4%. But marine products count for just 0.6% of the global export basket.

- Other examples where global export value is small, but India has a large share are: cut and polished diamonds (28.8%), jewellery (13.5%), rice (35%), shrimps (25.4%), and sugar (12.4%).

- Export Complexity Index (ECI) measures diversity and technological sophistication of goods exported by 130 countries. India’s rank was 42 in 2000 and 43 in 2019, mainly because of weak presence in Basket A products.

- China’s rank improved from 39 to 16 during this period due to expansion in Basket A products.

- Thus, a major thrust should be to focus on expanding presence in such products (Basket A).

- On the other hand, the small size of the Basket B sets the limit on the growth. Most such products being labour-intensive, low technology, face competition from low-cost countries.

Issues Associated With Manufacturing in India

- Inadequate Skilled Workforce: The manufacturing sector, for it to grow, requires an educated workforce with the necessary skills and training.

- India’s skill ecosystem needs to be fixed.

- Basic Infrastructure: Manufacturing labs, connectivity and transportation are slow and costly when compared to developed nations which is a huge deterrence to Industries.

- Uninterrupted power supply is another challenge.

- Small Size: Small enterprises, because of their smaller size, suffer from low productivity, preventing them from achieving economies of scale.

- Lack of Innovation Due to Low Spending On R&D: Currently, India spends about 0.7% of GDP on research and development, a considerably small amount when compared with other developed nations.

- This prevents the sector from evolving, innovating and growing.

- Low Productivity: In India labor productivity and capital productivity are both low. Compared with India, manufacturing productivity in Indonesia is twice as high; in China and South Korea, productivity is four times higher.

- For example, South Korea’s electronics manufacturing sector is 18 times more productive than India’s, and its chemicals manufacturing sector is an astonishing 30 times more productive.

Measures to Increase High End Product Export

- Lower Import Duties on Inputs: High duty on inputs results in expensive finished products that are out-priced by imported goods both in the domestic and export markets.

- Low duties make domestic firms competitive. Soon many will start shipping directly.

- Gradually, with better forward and backward linkages, jobs increase as both exporting and importing sectors grow.

- In Vietnam, five million workers work with direct exporters while seven million work for firms supplying products to exporters.

- Increase Access to Formal Finance: Enable top one million small manufacturing firms to get bank finance without collateral at regular interest rates.

- Less than 4% of small firms in India have access to formal finance. The figure for the US, China, Vietnam and Sri Lanka is 21%.

- Simplify Process of Exporting for Small Value Consignments: Many people buy local sarees, suits, handicraft, ready-to-eat/cooked products and ask the shops to courier to friends and relatives abroad.

- For such small value exports, it is needed to simplify and integrate compliances relating to Customs, GST, Directorate General of Foreign Trade (DGFT) and other concerned agencies.

- Schemes like making districts as export hubs would benefit from such simplification.

- The simplification will also help exports by small artisans and firms located in class B and C cities.

- Invite Large Anchor Firms in Critical Products to Set Up Operations in India: This is a tested strategy for promoting the manufacturing and export of Basket A items. Government initiatives like simplified labour laws, PLI incentives, low corporate tax on new manufacturing operations and scrapping of retrospective tax have enthused many firms searching for China plus-one location to shift base to India.

- India's large number of competitive ancillary units and skill base are a big plus over competing countries.

- Raising productivity: To become globally competitive, India’s manufacturing value chains must lift their productivity closer to global standards.

- Improvements to key manufacturing processes could increase the productivity of Indian companies in the chosen value chains.

- By adopting Industry 4.0 and automation technologies and investing in analytics, reskilling, and upskilling, Indian manufacturers could accelerate the production of high end products.

|

Drishti Mains Question It is imperative to shift manufacturing from low to high end products in order to achieve a higher economic growth rate. Discuss. |