Banning of Unregulated Deposit Schemes Bill 2019

Parliament has passed the Banning of Unregulated Deposit Schemes Bill, 2019, which seeks to put in place a mechanism by which poor depositors will get back their hard-earned money.

Provisions of the Bill

- Deposit: The Bill defines a deposit as an amount of money received through an advance, a loan, or in any other form, with a promise to be returned with or without interest.

- It also defines certain amounts which shall not be included in the definition of deposits such as amounts received in the form of loans from relatives and contributions towards capital by partners in any partnership firm.

- Unregulated Deposit Scheme: The Bill bans unregulated deposit schemes. A deposit-taking scheme is defined as unregulated if it is taken for a business purpose and is not registered with the regulators.

- Designated Courts: The Bill provides for the constitution of one or more Designated Courts in specified areas. This Court will be headed by a judge not below the rank of a district and sessions judge, or additional district and sessions judge.

- Central Database: The Bill provides for the central government to designate an authority to create an online central database for information on deposit takers. All deposit takers will be required to inform the database authority about their business.

- Competent Authority: The Bill provides for the appointment of one or more government officers, not below the rank of Secretary to the state or central government, as the Competent Authority. The Competent Authority will have powers similar to those vested in a civil court.The Competent Authority may:

- provisionally attach the property of the deposit taker, as well as all deposits received

- summon and examine any person it considers necessary for the purpose of obtaining evidence

- orders the production of records and evidence

- Offences and penalties: The Bill defines three types of offences, and penalties which are as follows:

- running (advertising, promoting, operating or accepting money for) unregulated deposit schemes. It will be punishable with imprisonment between two and seven years, along with a fine ranging from three to 10 lakh rupees.

- fraudulently defaulting on regulated deposit schemes. It will be punishable with imprisonment between three and 10 years, and a fine ranging from five lakh rupees to twice the amount collected from depositors.

- wrongfully inducing depositors to invest in unregulated deposit schemes by willingly falsifying facts.

- The repeated offenders under the Bill will be punishable with imprisonment between five to 10 years, along with a fine ranging from Rs 10 lakh to five crore rupees.

Impact

The Bill will help to tackle the menace of illicit deposit taking activities (Ponzi Schemes/Chit Funds) in the country, which at present are exploiting regulatory gaps and lack of strict administrative measures to dupe people of their savings.

Tiger Census Report

The Prime Minister of India has released the results of the fourth cycle of All India Tiger Estimation - 2018 on the occasion of Global Tiger Day-2019.

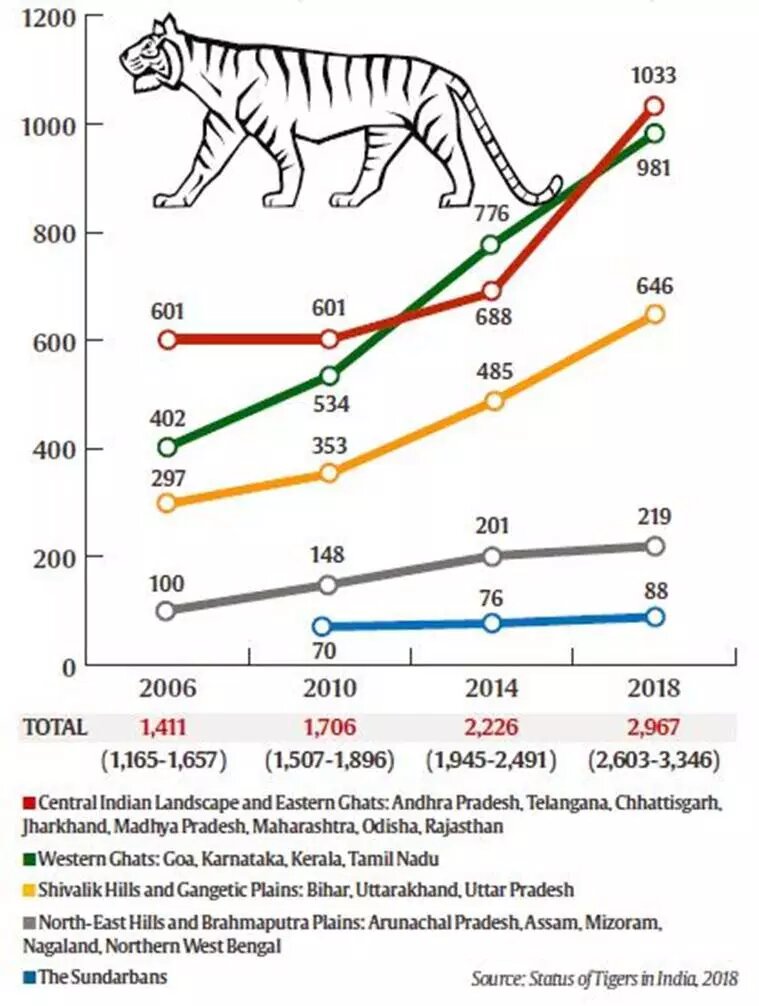

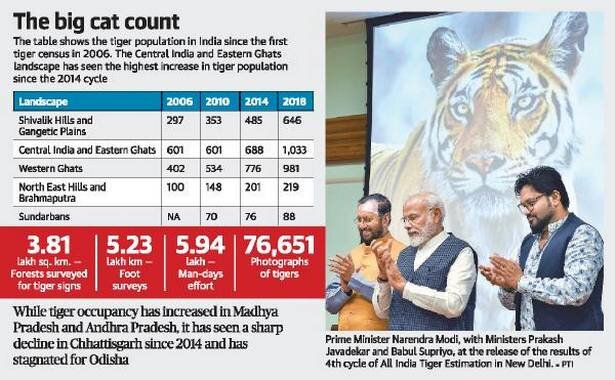

- According to results of the Tiger census, the total count of tigers has risen to 2,967 from 2,226 in 2014 — an increase of 741 individuals (aged more than one year), or 33%, in four years.

- India has achieved the target of doubling the tiger count four years ahead of the deadline of 2022.

- This is by far the biggest increase in Tiger count in terms of both numbers and percentage (since the four-yearly census using camera traps and the capture-mark-recapture method began in 2006).

Need for Tiger Conservation

- Tigers are at the top of the food chain and are sometimes referred to as “umbrella species" that is their conservation also conserve many other species in the same area.

- The Tiger estimation exercise that includes habitat assessment and prey estimation reflects the success or failure of Tiger conservation efforts.

- More than 80% of the world’s wild tigers are in India, and it’s crucial to keep track of their numbers.

Tigers in India

- India accounts for majority of the 3,500-odd tigers that are scattered among Bangladesh, Bhutan, Cambodia, China, Indonesia, Laos PDR, Malaysia, Myanmar, Nepal, Russian Federation, Thailand and Vietnam.

- India’s five tiger landscapes are: Shivalik Hills and Gangetic Plains, Central Indian Landscape and Eastern Ghats, Western Ghats, North-East Hills and Brahmaputra Plains, and the Sundarbans.

Key Findings

- Top Performers: Madhya Pradesh saw the highest number of tigers (526) followed by Karnataka (524) and Uttarakhand (442).

- Increase in Tiger population: Madhya Pradesh (71%) > Maharashtra (64%) > Karnataka (29%).

- Worst Performers: Chhattisgarh and Mizoram saw a decline in tiger population.

- Chhattisgarh is the only state out of the 20 tiger-bearing states where the 2018- census counted 19 tigers, significantly fewer than the 46 of 2014.

- Decline in Tiger numbers in Chhattisgarh can be attributed to the law and order problem as large parts of the state are hit by the Maoist insurgency.

- Greater conservation efforts are needed in the “critically vulnerable” Northeast hills and Odisha.

- Tiger Sanctuaries: An evaluation of India’s 50 tiger sanctuaries was also released along with the 4th National Tiger Estimation (Tiger census).

- Madhya Pradesh's Pench Sanctuary and Kerala’s Periyar sanctuary emerged as the best-managed tiger reserves in the country.

- Sathyamangalam Tiger Reserve in Tamil Nadu registered the “maximum improvement” since 2014.

- The Dampa and Rajaji reserves, in Mizoram and Uttarakhand respectively are at the bottom of the list in terms of Tiger count.

- No tiger has been found in the Buxa (West Bengal), Palamau (Jharkhand) and Dampa (Mizoram) reserves.

Global Tiger Day

- Global Tiger Day was observed for the first time in 2010 at the St. Petersburg Tiger Summit in Russia when all 13 tiger range countries came together for the first time with the commitment of doubling the number of wild tigers by 2022.

- It is celebrated annually on July 29th.

- Global Tiger Recovery Plan which outlines how each country can contribute to the ambitious goal, known as TX2

Sandbox for Fintech

Recently, the Insurance Regulatory and Development Authority of India (IRDAI) has allowed the use of regulatory sandbox (RS) to promote new, innovative products and processes in the Fintech industry.

- RS is an infrastructure that helps Fintech players to live test their products or solutions, before getting the necessary regulatory approvals for a mass launch, saving start-ups time and cost.

- It allows the regulator, the innovators, the financial service providers and the customers to conduct field tests to collect evidence on the benefits and risks of new financial innovations.

- For instance, Data analytics(a part of Fintech) is an area which insurance industry can take benefit to serve their customers as India accounts for around only 6% of insurance premium in Asia and around 2% of the global premium volume.

- Using RS the viability of data analytics in the insurance sector can be found out before its application on a mass scale.

- The Reserve Bank of India is also planning to provide similar infrastructure in the banking sector.

What is Fintech?

- Financial technology (Fintech) is used to describe new technology that seeks to improve and automate the delivery and use of financial services.

Examples

What is IRDAI?

- Insurance Regulatory Development Authority of India (IRDAI) is a regulatory body created with the aim of protecting the interests of the insurance customers.

- It regulates and sees to the development of the insurance industry while monitoring insurance-related activities.

History of insurance in India

- In India, insurance finds mention in the writings of Manu (Manusmrithi), Yagnavalkya (Dharmasastra) and Kautilya (Arthasastra).

- The writings talk in terms of pooling of resources that could be re-distributed in times of calamities such as fire, floods, epidemics and famine.

- 1818 saw the advent of the life insurance business in India with the establishment of the Oriental Life Insurance Company in Calcutta.

- The Indian Life Assurance Companies Act, 1912 was the first statutory measure to regulate life business.

- An Ordinance was issued on January 19, 1956 nationalising the Life Insurance sector and Life Insurance Corporation came into existence.

- General Insurance :

- In 1972 with the passing of the General Insurance Business (Nationalisation) Act, general insurance business was nationalized with effect from January 1, 1973.

- 107 insurers were amalgamated and grouped into four companies, namely National Insurance Company Ltd., the New India Assurance Company Ltd., the Oriental Insurance Company Ltd and United India Insurance Company Ltd.

- In 1993, the Government set up a committee under the chairmanship of RN Malhotra, former Governor of RBI, to propose recommendations for reforms in the insurance sector.

- Following the recommendations of the Malhotra Committee report, in 1999, the Insurance Regulatory and Development Authority (IRDA) was constituted as an autonomous body to regulate and develop the insurance industry.

- The IRDA was incorporated as a statutory body in April 2000.

- The key objectives of the IRDA include the promotion of competition so as to enhance customer satisfaction through increased consumer choice and lower premiums while ensuring the financial security of the insurance market.

Anti Dumping Duty on Purified Terephthalic Acid (PTA)

The Finance Ministry of India has imposed definitive anti-dumping duty on all imports of purified terephthalic acid (PTA) from South Korea and Thailand.

Meaning and Purpose of Anti Dumping Measures

- Dumping is said to occur when the goods are exported by a country to another country at a price lower than the price it normally charges in its own home market.

- This is an unfair trade practice which can have a distortive effect on international trade.

- Anti-dumping is a measure to rectify the situation arising out of the dumping of goods and its trade distortive effect.

- The purpose of anti-dumping duty is to rectify the trade distortive effect of dumping and re-establish fair trade.

- The use of anti-dumping measure as an instrument of fair competition is permitted by the WTO.

- In fact, anti-dumping is an instrument for ensuring fair trade and is not a measure of protection per se for the domestic industry. It provides relief to the domestic industry against the injury caused by dumping.

- PTA is the primary raw material in the manufacture of polyester chips, which in turn are used in a number of applications in textile, packaging, furnishings, consumer goods, resins and coatings.

- The latest action comes in less than a month after the Designated Authority in the Commerce Ministry came up with its final findings on the sunset review.

Sunset Review

- A Sunset review/ expiry review is an evaluation of the need for the continued existence of a program or an agency. It allows for an assessment of the effectiveness and performance of the program or agency.

- An anti-dumping duty is valid for a period of five years from the date of imposition unless revoked earlier.

- It can be extended for a further period of five years through a sunset or expiry review investigation conducted in accordance with Article 11.3 of the World Trade Organisation (WTO) Anti-dumping Agreement.

- Such a review can be initiated suo moto or on the basis of a duly substantiated request received from or on behalf of the domestic industry.

Institutional Arrangement in India for Anti Dumping Measures

- Anti dumping and anti subsidies & countervailing measures in India are administered by the Directorate General of Anti dumping and Allied Duties (DGAD) functioning in the Department of Commerce in the Ministry of Commerce and Industry and the same is headed by the "Designated Authority".

- The Designated Authority’s function, however, is only to conduct the anti-dumping & countervailing duty investigation and make recommendation to the Government for the imposition of anti-dumping or anti-subsidy measures.

- Such duty is finally imposed by a Notification of the Ministry of Finance. Thus, while the Department of Commerce recommends the anti-dumping duty, it is the Ministry of Finance, which levies such duty.

5G Trails

Department of Telecommunications (DoT) has issued guidelines for 5G trials across all available spectrum bands and is likely to allocate up to 400 MHz of radio waves for the trials.

Guidelines

- It provides for a uniform fee of Rs 5,000 for the trial licence.

- The period for trial licence may be between 3 months to 2 years depending on the purpose.

- Indian entities involved in research and development (R&D), manufacturing, telecom operators and involved academia can be issued licence for a period of up to 2 years.

- The DoT is obliged to grant permit for the trails between 4 to 8 weeks. In case of no response by DoT within the said period, the applicant can send notice for trials. Again if the applicant does not receive any reply within 2 weeks, it will be deemed as approval. .

Concerns

- According to the Global rating agency Fitch, the expensive spectrum and limited business case of 5G in the short to medium term might discourage some of the telcos like Airtel and Vodafone Idea to participate in the spectrum auctions.

- 5G may have only limited commercial viability in the short term, as 4G penetration is still low in India.

- There is little appealing content or applications which cannot be addressed by 4G speeds.

- Indian telcos lack extensive intra-city fibre infrastructure, which is responsible for poor internet experience relative to other markets and is also critical in order to provide a seamless 5G experience.

The government needs to be cautious and must go for comprehensive studies before the commercial rollout of 5G technology to ensure people’s safety.

GI Tag for Odisha Rasagola

Odisha, has received the Geographical Indication tag (GI) from the Registrar of Geographical Indication.

- Odisha Rasagola is a sweet made of chhena (cottage cheese) cooked in sugar syrup using the principle of caramelisation of sugar (caramelization is the browning of sugar, a process used extensively in cooking for the resulting sweet nutty flavor and brown colour).

- Odisha Rasagola is associated with world famous Puri Jagannath Temple.

- Both Odisha and West Bengal have been contesting the origin of the rasagola.

- West Bengal received GI tag for its variety of rasgulla in November 2017.

- The reference of rasagola is found in the late 15th-century Odia Ramayana written by Balaram Das.

- Balaram Das’s Ramayana is known as Dandi Ramayana or Jagamohana Ramayana as it was composed and sung at the Jagamohana of the Puri Temple.

- A religious script named “Ajodhya Kanda” gives elaborate descriptions of chhena and chhena‐based products including Rasagola.

- Famous Odia writer Fakir Mohan Senapati, in his writing Utkal Bhramanam (published on August 27, 1892 ) mentioned about the plentiful use of rasagola in Odisha during those days.

- ‘Bali Jatra’ a poem written by Damodar Pattanayak is an eye‐witness of Cuttack’s famous, historic fair, Bali Jatra (Journey to Bali Island of Indonesia) and mentioned that sweets shops were looking attractive in presence of Rasagola and other sweets.

- The first Odia product to receive a GI tag was Kandhamal Haldi, a type of turmeric produced by tribal farmers in the state's Kandhamal district.

Earth Overshoot Day

The Earth Overshoot Day fell on 29th July, 2019. The day marks the date when humanity’s demand for ecological resources (fish and forests, for instance) and services in a given year exceeds what the Earth can regenerate in that year.

- The concept of Earth Overshoot Day was first conceived by Andrew Simms of the UK think tank New Economics Foundation, which partnered with Global Footprint Network in 2006 to launch the first global Earth Overshoot Day campaign.

- At that time, Earth Overshoot Day fell in October.

- World-Wide Fund for Nature (WWF), the world’s largest conservation organization, has participated in Earth Overshoot Day since 2007.

- It is computed by Global Footprint Network by dividing the planet’s biocapacity (the amount of ecological resources Earth is able to generate that year), by humanity’s Ecological Footprint (humanity’s demand for that year), and multiplying by 365, the number of days in a year:

Earth Overshoot Day = (Planet’s Biocapacity / Humanity’s Ecological Footprint) x 365

- Global Footprint Network is an international non profit organization founded in the year 2003. It’s key strategy has been to make available robust Ecological Footprint data.

- The Ecological Footprint is a metric that comprehensively compares human demand on nature against nature’s capacity to regenerate.

LCU L-56 Commissioned into Indian Navy

Indian Navy has recently commissioned the ship LCU L-56, which is the 100th warship built by the Garden Reach Shipbuilders and Engineers (GRSE).

- LCU 56 is an amphibious ship with its primary role being transportation and deployment of main battle tanks, armoured vehicles, troops and equipment from ship to shore.

- It is the sixth of eight indigenously built Landing Craft Utility (LCU) MK IV class ships.

- The LCU Mk-IV Class of ships are fitted with close to 90% indigenous content, in line with the Government of India’s ‘Make in India’ initiative towards achieving self-reliance and indigenisation.

- The induction of LCU 56 will add to maritime and Humanitarian Assistance and Disaster Relief (HADR) capability of Andaman Nicobar Command.

- The ship will be deployed for multi-role activities such as beaching operations, search and rescue missions, disaster relief operations, coastal patrol, and surveillance operations along the Andaman and Nicobar Group of Islands.

Kan Sikul, Kan Huan

Mizoram’s Lawngtlai district administration’s project Kan Sikul, Kan Huan (My School, My Farm) has been made the model for all schools and colleges in Mizoram.

- Kan Sikul, Kan Huan aims to curb the problem of shortage of fruits and vegetables in the region by setting up the kitchen/ nutrition gardens in every school.

- The project seeks to make Lawngtlai self-sufficient in the local variety of fruits and vegetables and fight malnutrition among children (by March 2020) by letting every school, Anganwadi, child care institutions and hostel in Lawngtlai to grow their own fruits and vegetables with the help of teachers, parents and community members.

- Project is in consonance with the objectives of central governments Poshan abhiyan.

- Lawngtlai, is Mizoram’s most backward and disaster-prone district with 35.3% stunted, 21.3% underweight and 5.9% severely wasted (low weight-for-height) children under 5 (highest on all counts in Mizoram).

- Kitchen /nutrition gardens have yielded in improving the nutritional content of the midday meal served in the schools.

Code of Conduct for Proxy Advisors

Recently, the Securities and Exchange Board of India has proposed a code of conduct for proxy advisory firms.

- The code of conduct will involve a ‘comply or explain’ approach wherein listed companies aggrieved by the view of proxy advisors can approach the SEBI for redressal.

- Comply or explain is a regulatory approach in which listed companies may either comply with or if they do not comply, explain publicly why they do not.

- The proxy advisor is a person/ firm who provides advice to institutional investors or shareholder of a company to exercise their rights in the company including recommendations on public offer or voting recommendation on agenda items.

- According to SEBI, the proxy advisor should take appropriate steps to disclose any potential conflicts of interest resulting from ancillary business activities.

- Also, the board of proxy advisors should be independent of its shareholders, as such a position creates a serious conflict of interest.

- Besides this, SEBI has also suggested that institutional investors like foreign portfolio investors, portfolio managers, alternative investment funds and infrastructure investment trusts etc., should ensure that proxy advisory firms employed by them have appropriate capacity and capability to issue proxy advice.